- Bitcoin price is eyeing a breakout towards $13,000, according to Bloomberg analyst Mike McGlone.

- The senior commodity strategist stated that the cryptocurrency’s declining volatility is making it a digital version of gold.

- He also highlighted BTCUSD trading inside a bullish technical structure.

Could Bitcoin price break above $10,500, a technical resistance it has repeatedly failed to breach since September 2019? Bloomberg analyst Mike McGlone thinks so.

How?

The senior commodity strategist said Friday that he sees Bitcoin hitting $13,000 in the coming sessions. He gave two reasons to justify its bullish call for the cryptocurrency. The first mentioned the asset’s declining volatility, while the other highlighted one technical pattern that promised an upside breakout.

“Bitcoin is caged bull set for [a] breakout, eying $13,000 Resistance,” Mr. McGlone headlined as he added that a plummeting Bitcoin volatility reflects its “maturation toward a digital version of gold.”

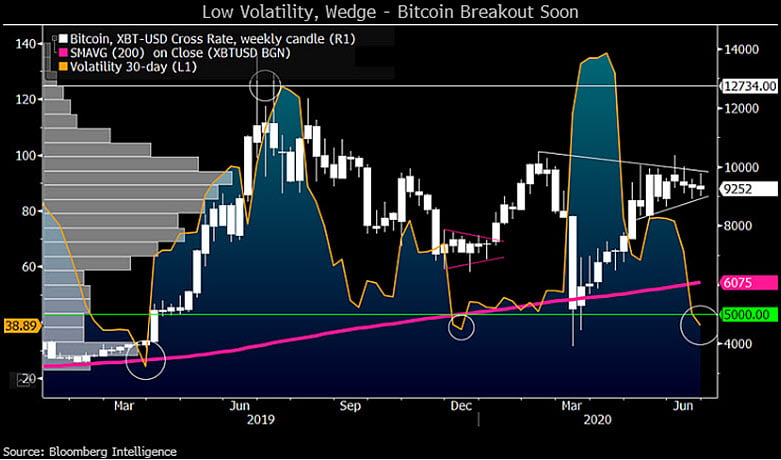

Bitcoin price trending inside a symmetrical wedge as its volatility dips below its 200-SMA average. Source: Bloomberg Intelligence

As for the technical pattern, the analyst noted that Bitcoin is trending in a symmetrical wedge (that appears like a Triangle). At the same time, the cryptocurrency’s 30-day volatility breached below its 200-day simple moving average.

The chart shows two similar fractals from the past, wherein the bitcoin price rose exponentially after the 30D volatility tested the 200-DMA. Meanwhile, the symmetrical wedge, which followed a 150 percent price rally, further hinted an uptrend continuation.

“The more disdain from bulls should be for the better, keeping the price tilted upward for the consolidating crypto,” commented Mr. McGlone.

Bitcoin Price Falling

Mr. McGlone’s bullish outlook for Bitcoin came on the day when the cryptocurrency was extending its downside correction.

The BTC/USD exchange rate on Friday fell to as low as circa $9,076, down 7.30 percent from its week-to-date high. The plunge appeared ahead of the expiry of over $1 billion worth of Bitcoin options contracts across several derivative exchanges.

Observers were anticipating turbulent price moves as options traders attempt to move spot bitcoin rates in the direction of their options strike price.

Nevertheless, data on Skew showed that a majority of call options targeted $10,000 and $11,000 as their strike price while those with put options expected spot price to fall as low as $8,000.

“Heaviest volume is for calls at 10k and puts at 9k,” one analyst wrote on Twitter. “The max pain scenario would be bitcoin simply ranging sideways. I think this is what will happen.”

If the scenario plays out, Bitcoin will continue trending sideways after the record options expiry today. It will also stay in the range of Wedge highlighted by Mr. McGlone.

from NewsBTC https://ift.tt/384enfj

Find The best Lending Program Top CryptocurrencyLending Program

Tidak ada komentar:

Posting Komentar