- Bitcoin price declined heavily and tested the $8,000 support area against the US Dollar.

- The price recovered nicely and traded above the $8,300 and $8,450 resistance levels.

- There is a rising channel forming with support near $8,450 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is facing a solid resistance near the $8,600 area and the 100 hourly simple moving average.

Bitcoin price is currently recovering above $8,450 against the US Dollar. BTC needs to surpass the $8,600 barrier to move back in a positive zone and climb further higher.

Bitcoin Price Analysis

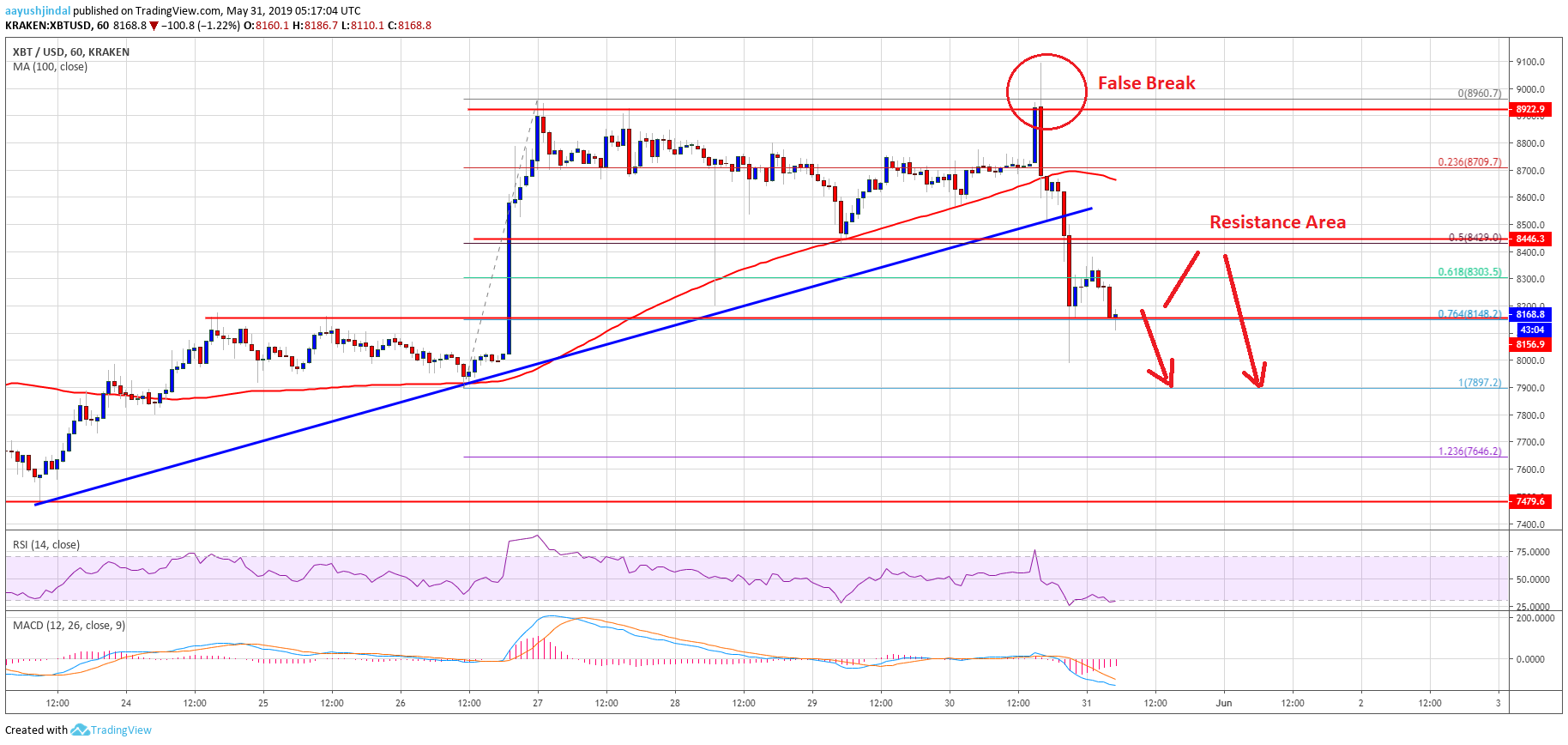

Recently, bitcoin price declined sharply after pumping to a new 2019 high at $9,091 against the US Dollar. The BTC/USD pair collapsed below the $8,800 and $8,600 support levels. The decline was strong and gained pace below the $8,450 support plus the 100 hourly simple moving average. Moreover, there was a clear break below the $8,300 support and the $8,220 pivot level. The price traded close to the $8,000 level, where the bulls protected further losses.

A swing low was formed near $7,999 before the price started a strong recovery. There was a pump above the $8,300 level and the 23.6% Fib retracement level of the recent decline from the $9,091 high to $7,999 low. More importantly, the price traded above the $8,450 resistance. At the moment, the price is trading above the 50% Fib retracement level of the recent decline from the $9,091 high to $7,999 low. Besides, there is a rising channel forming with support near $8,450 on the hourly chart of the BTC/USD pair.

On the downside, there is a strong support forming near the $8,450 level. If there is a downside break below $8,450, the price might restart its decline towards the $8,300 level. The next key supports are near the $8,220 and $8,150 levels. On the upside, the main resistance is near the $8,600 level and the 100 hourly SMA. The 61.8% Fib retracement level of the recent decline from the $9,091 high to $7,999 low is also near the $8,670 level. Therefore, a successful break above the $8,600 and $8,670 levels is needed for more gains in the near term.

Looking at the chart, bitcoin price recovered nicely above $8,450 and it is currently showing positive zone. If the bulls remain in action and push the price above $8,600, there are chances of bullish continuation.

Technical indicators:

Hourly MACD – The MACD is back in the bullish zone, with positive signs.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD climbed back above the 50 level, with a positive angle.

Major Support Levels – $8,450 followed by $8,300.

Major Resistance Levels – $8,600, $8,670 and $8,800.

The post Bitcoin (BTC) Price Recovers Sharply: Can Bulls Overcome Hurdles? appeared first on NewsBTC.

from NewsBTC http://bit.ly/2W6mRuG

Find The best Lending Program Top CryptocurrencyLending Program

(@Josh_Rager)

(@Josh_Rager)