As the crypto market continues to ride rough waves, we at NewsBTC decided to throw some questions at OKEx’ team to get a better understanding of how they view these developments and the impact on their own operations.

In a first, the OKEx team got together to paint a clear picture by providing detailed, in-depth responses to our questions. The representatives who participated in the interview include Robbie Liu – Market Analyst at OKEx, Hunain Naseer – Senior Editor at OKEx Insights, Richard Delany – Senior Analyst at OKEx, and Jay Hao, the CEO himself.

Read the interview below.

NewsBTC: Bitcoin has been performing really well for the past few months, and yet experienced a sudden downturn in a matter of hours. What changed?

Robbie Liu, Market Analyst: While the major drop happened in a matter of hours, BTC had lately stalled in terms of price action, failing to conclusively breach and stay above $60,000 for about 10 weeks. This persistent resistance had already put pressure on the bulls, and the recent news developments acted as triggers for bears to enter. The initial decline was a result of market sentiment turning bearish, but it was further worsened as billions worth of over-leveraged longs were liquidated in quick succession.

Besides the high leverage, the meme-coin frenzy had also peaked, drawing capital away from Bitcoin and major cryptocurrencies. This pushed Bitcoin dominance to its lowest level of 40% during this bullish run, while also signaling the market could reverse soon.

NewsBTC: In the recent OKEx Insights report, it was indicated that Coinbase market listing as one of the causal factors for declined interest in BTC. Can you deduce the sentiment behind it?

Hunain Naseer, Senior Editor: The Coinbase listing was a majorly hyped event and acted as a catalyst for BTC to post a new all-time high. However, as is common in the crypto space, and in other speculative markets, traders take positions prior to a major development and take profits just prior to the actual event and after it. The same was seen in this case, where buying was seen ahead of the listing and selling pressure emerged after it took place.

NewsBTC: Tell us more about the existing correlation between BTC, ETH and other traditional global assets.

Hunain Naseer, Senior Editor: In recent weeks, the correlation between BTC and ETH had weakened as the former stalled and the latter went on to post new highs above $4,000. The same was the case with altcoins, albeit to a lesser extent, where they followed ETH but did not completely detach from BTC either. In terms of correlations with traditional assets, BTC and tech stocks have been strongly correlated lately, with any major selling in the sector also impacting BTC’s price.

NewsBTC: If my understanding is correct regarding the US Treasury yields, the logic dictates that low yields will encourage investors to look for alternative assets, like say Bitcoin. However, in the past few months, the yields seem to have gotten better each day, with a healthy spread between the short and long term. Yet, BTC continued to maintain a decent price level, even recovered for a while before crashing. How do you read this?

Robbie Liu, Market Analyst: Since the pandemic started last year, the Fed has prioritized fiscal stimulus packages and asset purchases, which pushed the Treasury yields to nearly zero. However, minutes from the FOMC April meeting revealed last Wednesday signaled possible tapering.

As a result, the three major U.S. stock indexes plunged about 1% during Wednesday, which also coincided with BTC’s crash. BTC bottomed out at the same time as the S&P 500 around 1:00 pm UTC after dipping below $30,000. Meanwhile, the 10-year U.S. Treasury yield set a new daily high, moving up nearly 4 basis points to 1.6762%.

The market’s reaction illustrates that Bitcoin is currently a risky asset along with equities, and both will endure the re-evaluation that comes with rate hikes. It takes time for the market to adjust to possible changes in interest rates. Historically Bitcoin has gone through both rate hikes and rate cut cycles and more importantly Bitcoin performs better when the market Volatility Index is hovering at low levels.

NewsBTC: With the crypto market going crazy in the past few weeks leading to this week’s events, there is bound to be some confusion among the trading community. What was the effect of these events on OKEx’ s operations?

Jay Hao, CEO: Given the sideways movement in terms of price during mid-May, we noticed dropping community engagement but saw increasing trading volumes and participation in campaigns as market participants sought to take advantage of the lower prices.

NewsBTC: Ethereum has been one of the great performers and its rise has been good to the altcoin ecosystem. Can you please shed some light on what the impending implementation of ETH2.0 will mean to the market?

Richard Delaney, Senior Analyst: Among other changes, ETH 2.0 looks to radically improve Ethereum’s transaction capacity. If successfully implemented, the scalability benefits of data sharding should encourage further growth of both the DeFi and NFT sectors, and may also enable innovative new sub-industries as familiarity with the tech spreads.

Similar to BTC price action in the weeks before and after the 2017 summer hard fork, it’s likely we’ll see heightened ETH price volatility around key transition dates. Although the change is widely accepted across the community, any major upgrade introduces many unknowns, which will presumably be reflected in ETH price.

After the transition, there may be a sudden growth in the number of ETH staked on the network, too. ETH staked today can’t be unstaked yet. Therefore, staking today requires confidence in the successful rollout of ETH 2.0. Even though around 4.8 million ETH have already been staked, it seems fair to presume that many users will be waiting until after the upgrade’s successful completion to commit funds to the revamped network’s security.

Despite the recent price volatility, a number of complementary factors support a higher ETH price in at least the medium term. In addition to the network scaling to accommodate more users and the removal of ETH from the market via staking, EIP-1559 looks set to significantly reduce Ethereum miner selling pressure by burning a large percentage of transaction fees.

NewsBTC: What is the impact of rising transaction fees on Ethereum network on ETH/Crypto or Fiat and ERC20/Crypto or Fiat trading pairs? How did it affect activities on OKEx platforms and what does it mean for the future of ETH?

Richard Delaney, Senior Analyst: Rising transaction fees obviously discourage people from using the Ethereum network. Complex transactions involving DeFi protocols or NFT minting can quickly get prohibitively expensive on the base blockchain, leading to the impression that Ethereum is a rich person-only playground.

The recent growth of Ethereum-bridged blockchains and layer-2s offering cheaper transaction fees shows there’s a big appetite for a lower-cost version of what Ethereum offers. As its scaling technology improves with solutions like Polygon and ETH 2.0, Ethereum’s superior liquidity and other network effects will likely attract many new users and re-attract some users from so-called “Ethereum killers”.

NewsBTC: What is your outlook for BTC and ETH in the coming months? Any warning signs traders should look out for?

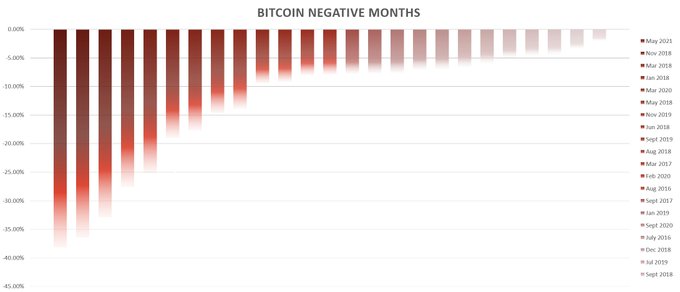

Robbie Liu, Market Analyst: Looking back at the bull market from 2016 to 2017, Bitcoin has never seen three consecutive months of declines. Given this, it would not be surprising if the market rallies in June instead of posting another red month. But an extremely quick rally back above $60,000 is probably too idealistic. Bitcoin will still encounter a lot of selling pressure due to the previous large amount of buying in the $40,000 to $60,000 range.

Looking at Bitcoin’s dominance, it bottomed out from 40% before Black Wednesday, a 3-year low since May 2018. We expect the dominance ratio will not fall below 40% in the upcoming weeks, meaning investors would cycle back into Bitcoin due to the worries about another reset. Last week’s big retracement is still more likely to be a mid-cycle correction. On-chain data shows smart money from whales started to accumulate coins again.

Since Bitcoin is now increasingly correlated with macro events. Macro risks, including the FED’s tapering calendar and China’s possible further regulations, could be reasons to put traders into another selloff.

NewsBTC: Meanwhile, the ETH L2 tokens, especially MATIC have registered impressive gains in the past months. Is it a trend that is here to stay?

Richard Delaney, Senior Analyst: MATIC’s growth — both in terms of price and users — following the project’s rebrand to Polygon earlier this year demonstrates clear user demand for lower-cost Ethereum DApps. With Polygon radically simplifying the onboarding of developers to L2s, it seems likely that it will remain relevant for some time to come.

Some question Polygon’s relevance post-ETH 2.0 because both address network scalability. However, with it still unclear when or even if shards will be able to process the more complex computations required for smart contracts, Polygon and other L2s are expected to complement the upgrade rather than compete with it.

NewsBTC: What is OKEx currently working on? Can we expect some big announcements anytime soon?

Jay Hao, CEO: OKEx is working to support direct deposits and withdrawals onto Ethereum scaling solution Arbitrum. We are currently conducting due diligence to estimate how quickly the integration can be implemented once the Arbitrum mainnet goes live. Apart from this we’ve got other things in the pipeline in terms of popular listings and OKExChain, stay tuned.

Image by Buffik from Pixabay

from NewsBTC https://ift.tt/3vBGCgr

Find The best Lending Program

Top CryptocurrencyLending Program