This is an intermediate to an expert level article on NFTs. If you only want to understand the first things about it, scroll to the end, or alternatively find a beginner level feature.

Everybody wants big-league gains but ain’t willing to do what it takes to deserve it.

We have a pandemic level cultural illiteracy and incentive model problem, threatening the promising start of the crypto and NFT art movements. The, mostly unconscious, skewed foundational motivation bends will soon bite it in the butt, but some of us can pre-warn some people open to listening.

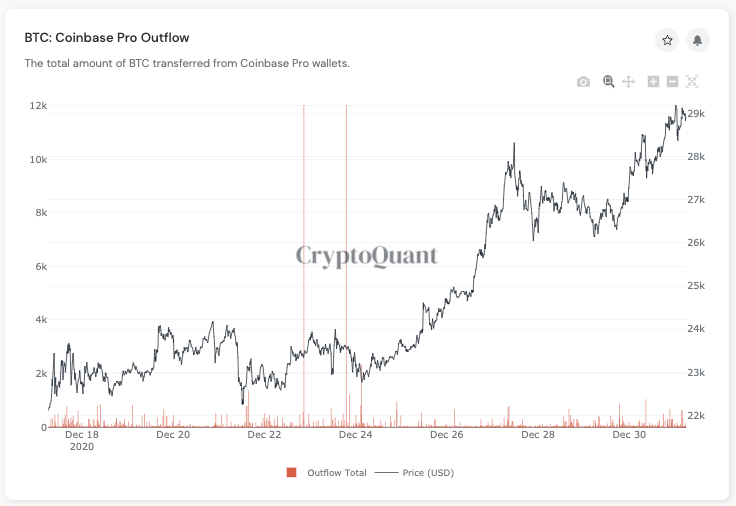

The whole thing stinks of the 2017 ICO boom so much that, while I like, and even need to party, I can already hear the next three years of ‘NFTs are a scam’ bile happening due to the ongoing, somewhat self-inflicted, starry-eyed, and delusional stripper money excitement.

I’m an artist, not a critic, but there isn’t anyone here to do this job, so without mentioning names, I’ll give it a go. This hopefully will show what it takes, should a real emerging critic take the job, and why I shouldn’t do it, even if I can. It’s a tall order though, as they will need to have an understanding of art history, economics, technology, and the culture wars. The reason I can say this is that I had to figure out why the previous experiences in the legacy art world were so hellish for an innovator, and why I was equally optimistic three years back about crypto.

Sure we are the beginning of a digital revolution, but it’s increasingly, ideas-wise, looking like old mediocre bullshit in a new wrapper celebrating the same old money hype – at the expense of its actual potential impact of liberating a whole class of creative people. This article is an attempt to raise the bar of the current conversation resolution in a culturally significant way, so it will undoubtedly ruffle some feathers.

Sure we are the beginning of a digital revolution, but it’s increasingly, ideas-wise, looking like old mediocre bullshit in a new wrapper celebrating the same old money hype – at the expense of its actual potential impact of liberating a whole class of creative people. This article is an attempt to raise the bar of the current conversation resolution in a culturally significant way, so it will undoubtedly ruffle some feathers.

I don’t claim to be the most technically savvy person, and that part of NFT’s seems to be doing fine. Some say only trust the swarm intelligence, and I would if I saw more evidence of it from the expression side, however. I’ve fought for too damn long and too damn hard just to let this slide – so here goes a hail Mary. If nothing else, consider it a cathartic last thing of 2020, from which we can all bounce into a further upward cycle well.

Release Us From Metaverse Spin

So no one needs to be on the defence any more than they have to, please allow me to state why this is caused by all of us together, and it started before any of us were even born. It’s not the fault of the artists, the collectors, curators, absent critics, corporations, the institutions, the ideologies, the banking system, or even the Jungian shadow in us all – well, maybe quite a bit the last one.

Defiance of authority is cool, but is something being lost in translation?

As most of the sales are now focused on the US, we need to acknowledge important historical, ideological & world culture aspects of recent centuries, and decades. As an outsider familiar with American culture, this is easy to see. In many ways, I feel more entrepreneurial than European, so this is not coming from a hater perspective. I grew up with Ghostbusters, The Blues Brothers, Star Wars, James Brown, and much more like the rest of us – perhaps relating to it more than most in Finland.

The rebellious innovation nature of the American culture is, that what is seen as an inheritance of Kings & Queens, is elitist crap, and we can make billion-dollar companies wearing jeans and t-shirts. This is especially true in the Silicon Valley tech culture. It is now also famous for wanting to look good for the cultural left while strip-mining everyone’s data, making untold fortunes without paying taxes & limiting freedom of speech rights. There is a simultaneous disdain for so-called ‘high-culture’ as well as a yerning for credibility, which is now causing cognitive dissonance and despair for the rest of us.

The Premature Death & Potential Rebirth Of The Word NFT Art

One of the first things you learn in art school you learn – or you used to learn before the culture wars took it over – was that this is not a pipe. The above is a picture of a pipe. The image points to something and is not the thing itself. Even if it has fancy light effects and you make it into a short animation. The Derrida‘s of the world, however, made the signal more important than what it was pointing to, so here we are.

The Rene Magritte work points to the naive realism now taking over the movement almost fully. Due to the western neo-Marxist revolution, this is now elitist talk in Europe, too, but is very connected to evaluating NFT art, and for it to grow into adulthood. The ‘neo-comms’ of course don’t like it that there is talk of their revolution, so likely some will attack it as a conspiracy theory by them, and those clueless of its influence. I’ve watched all the same activist documentaries, were heartbroken over them, and more, but this is way out of hand now. To some, this camouflage crap simply won’t fly anymore. The price these Children of corn are asking for letting them freely further erode western society, alongside the financial fiat money system, is simply too high. It’s not their fault, but they aren’t capable of knowing what they were indoctrinated into. Before calling me a right-wing pundit, however, please at the very least check out this solar energy activist art project called LUX, which took me 3-years to make. Entering crypto after making it, balanced a whole bunch of things out, that you simply don’t learn in a left-wing university, like mine was and still is.

Vesa, what the hell are you on about?

We are just getting started with NFT’s, and it’s going great!

No one needs critics. They are so negative.

Right?

The Iceberg NFT Analogy

To trust in naive optimism is cute, but if we want those big league gains to come from something not resembling intellectual death and/or pure wash trading, the culture wars underneath the visual part of this emerging space needs to surface. We now evaluate, and mostly reward the works presented by the artists on an embaressingly superficial level, leaving out the spectrum almost entirely what the underlying culture is. Of course, due to what collectors now recognize as ‘brilliant’ are mostly ideas done to death in the legacy art world, and has anyone innovating actual new things with authentic voices rolling their eyes. Just because you tokenize an old idea, calling it genius is what keeps us from getting credibility for actual innovation. You also can’t wash trade like crazy, while saying blockchain solves old world problems.

I’ve made myself persona non-grata in many circles for having pointed some of this out since the beginning. Artists, collectors, and platforms are made of people, and people seldomly like critique – especially if it comes from other artist – so the sycophantic cycle is now on autopilot. It’s just that someone has to state the obvious flaws of it all, since we don’t have any actual new wave, integral NFT critics in this space yet.

Just know, btw, that this comes from the perspective of someone who innovated in the legacy system for a decade before crypto, at a great expense to my finances, mental health and faith in humanity. It really was the worst, jaded, insider world designed to keep innovation out, rather than embrace it. This is part of the reason I’m writing all this. I’m seeing the same crap enter this world now. I’m sure I still have many blindspots, but my on-the-spectrum Aspergers allows me some true definace to this direction.

Camille Paglia, the The Dark Women, Stratford Festival Forum lecture on Youtube.

Nobody Is an NFT Critic

To substantiate the love of US from an intellectual standpoint, much of my education comes from learning the lion’s share of my mindset from arguably one of the most comprehensive philosophers of all time, Mr. Ken Wilber. He is the father of integral theory, which is by far one of the most credible models for us to get out of many of the jams we are currently in. The trouble is, most haven’t even heard his name. He, of course, borrows a lot of his insights from the great Eastern traditions, so there is a merry-go-round in the spirit of Bruce Lee going on with him. If someone says the word integral, and it won’t include the whole world, that ain’t it.

Spirituality, as pointed out by Sahdguru, is likely even more corrupt of a word than art, but just because the word has eroded, it still keeps pointing to the real thing. Without this grounding, I would have surely been beaten down by this world many times over by now. The reason this matters, is that art has it’s origin foundations in religion, and we all know what has happened to the insititutions of that realm. If you don’t think this has anything to do with NFT’s, please allow me to elaborate.

The other, massively important person to follow, is another US native Camille Paglia. She has outlined the problems of the education system, cultural decline, and intellectual suicide for decades. We simply have nothing like these two as any kind of influence on our emergin NFT scene, and we should. They are not the low resolution perception on what a bad, technologically clueless, financially illiterate, and void of vision critics of culture are now seen as.

There are phenomenal use cases of visualization and tech adoption happening in the NFT space. It has legitimate doubts about the legacy world entering, embracing, or imposing any of its ways into it. Like Camille says, the current art establishment only leaves out the religious roots of art, ancient Egypt, antiquity, the enlightenment, societal & natural sciences, non-propagandist history, and political nuance from it’s current evaluation model.

However, this is what is now being used as a watered down version of credibility footnotes to know which artists are ‘innovative’ from a cultural standpoint. It leaves many with real innovation, substance, and authentic voices competely out to dry. I don’t only mean those maybe thinking about entering, but some of us still sticking around.

“At particular times, a great deal of stupid people have a great deal of stupid money” – Walter Bagehot, Economist, 1859

The problem from the last ‘develpments’ of the legacy art world were brilliantly outlined by the BBC “The Great Contemporary Art Bubble” documentary, how many newly rich people wanted shiny things, and the art world printed their fiat crap to suit them – making billions in the process. The second part is the cultural Marxism embrace, largely due to the nihilistic financial future of us all, as the monetary system started it’s death spiral in 2008.

Let’s collab, Bro!

Let’s get another disclaimer out the way. I have nothing against great collaborations, nor being communally social. I come from a film background, in which you need a 100 people to pull something off. If people can compensate for the lacking skills they have in certain areas, they can do increasingly incredible things.

The inheritance of the legacy system degeneration is that the artists are now meant to be seen as people who ony help each other – while actually struggling towards the top sales in a super limited collector space mostly ignorant of art. The inherent conflict needs to exclude acknowledgement of the competition aspect inside it at all, as well as the pandering to people who don’t know what to demand for their money. The amount of knives stuck in various backs, including mine behind the scenes, aren’t stories they write about on Cent WIP’s or community Whatsapp groups. It’s straight from the communist playbook of ‘what we will say and what will actually happen’. The whole output of the so-called Intellectual Dark Web will help you understand this paradigm, should you want to get it on a deep level.

This leads me to the collaboration hype model, which is now prominent, and a hangover inheritance of the post-modern neo-communists hijacking the cultural space, in which art almost solely serves ideologies and causes in the big picture. This is why we have people making statements like ‘everything is political and about oppressive power’. It’s the death of art, and it’s been going on for a while. There are many reasons to write this, but what is now happening almost entirely unnoticed, is that the worst aspects of the legacy corruption, are now seen as intellectual footnotes of validation to a space trying to entirely re-invent the wheel. They look down upon everything in the legacy system, quite frankly, because they don’t understand it and vice versa. This is why the below the water line iceberg matters. You see, these corrections will eventually come from the outside if we don’t do it from the inside. We won’t have a say in the matter, and it will be a whole lot more embarrassing if it comes from the outside in.

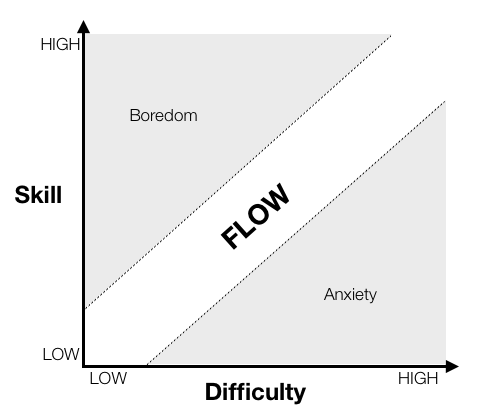

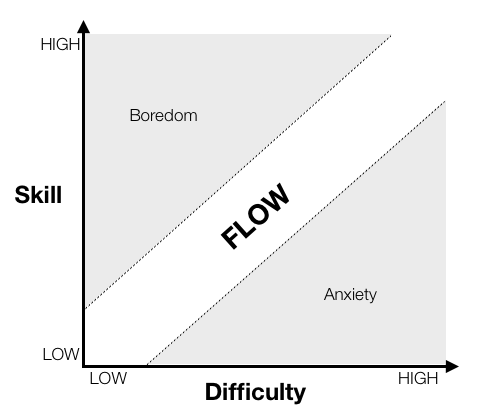

The Flow State

You see, I can only be seen as being supportive and appraising of my fellow artists, even if they blatantly rip me off, use absolutely done to death concepts, fool investors with facepalm level concepts, etc. The reason I want critics to come in is that someone has to do the dirty work of separating the actual seeds from the sea of dry intellectual land, or we all suffer. Anyone who knows what has been done to death, won’t be impressed by something that was revolutionary 50-years back. The more accurate pointer can’t be me, as that would cost me even more than this has already cost me now. It would further alienate investors, make enemies out of my fellow artists, and give me a ‘negative aura’. The truth is, I’ve even been so nice that I haven’t named the other artists I could easily prove ripped off my concepts, art, and process thus far.

The truth about human development is that we require both challenge and support to grow in an equal measure. Inside the community, we have plenty of support for one another, but all emerging critics have been removed as soon as they started pointing things out. There is plenty of real challenge of finance, education, and platform development, as well as artistic expression progress, but we have come a long way. This is the real love coming from me to write this all. The quality improvement last year alone was a light-year leap from the previous.

Crypto killed the gallery star NFT by Moxarra Gonzales

The NFT Machine

NFT’s end the dark ages of corporate servitude for digital creatives as we have known it since the beginning of computers. It also does the very counter-intuitive thing to end the era of computers mostly being good for replicating things endlessly.

It also ends an era of ideological servitude to the culturally dominant and oppressive narratives like the ever-present postmodernist one. Should you want to know what I am talking about, please refer to this talk with Jordan Peterson & Camille Paglia. Kid gloves are removed, and that is one of the best things to happen to art in a while. It will also put into context in a much more direct and brilliant way everything I was trying to say here.

The best way to describe the revolution is to juxtapose it with the arrival of MTV in the ’80s. The youth culture, opportunity, and feel of it swallowed all criticism, like the Dire Straights song, and birthed a creative renaissance. This time though, the context is much wider involving digital land ownership, digital art, digital permanent certificates for physical things, avatars, game items, brand collectibles, and things we’ve yet to imagine. This is not lost on me, but also, what the MTV culture started, was a rebellion that has now been done to death also. The culture rebelled so much, that it now hasn’t a clue about what it is rebelling against, leaving it feeling mostly just vacuous. The crypto art movement, for those of us who were there in the beginning, meant an army of artists fighting for a new money movement to help the world re-open its blocked arteries. The corporate overlords have now all but removed all traces of it in the Wikipedia page, and you can but wonder about the audacity this moderator does it with.

Neo-Conservative Elements in Art

I’m a nude bodypainting, tech & innovation loving, crypto, meme, and pop culture embracing progressive human, who embraces various spiritual concepts. This said, the new rebellion has conservative elements, that are now the direction out of the nihilistic youth culture of the ’80s and 90’s continued to the opioid epidemic. As much as I love the 60’s counter-culture figures, they are mostly now, invalid for what real liberals actually need. The rigor mortis conservative relics still do, but they aren’t here to listen to anything I have to say anyway. The new liberals need financial literacy, crypto, Austrian economics, a balanced perspective, and some real patience with their own team.

“The only way to make sense out of change is to plunge into it, move with it, and join the dance.” – Alan Watts

Ends and Means

So, what have I done in order to feel like someone who can point this out? I actually managed, in the eyes of art history, to renew the process of portrait painting into a new visual language, and digital originals in 2008. That was also the year I made my first pricing innovation and was featured in Finland’s two top economic papers about it starting 2009. I’ve been a full-time crypto artist now for 3,5 years, with various pushes of boundaries, and my tokenized NFTs aren’t currently selling.

I was also left out of the recent Decrypt article on NFT innovators, and even my limited edition 1 ETH works aren’t currently flying off the shelves. Nifty gateway won’t have me on their platform, and Async art denied me access too, despite the obvious compatibility. I wonder why because it’s not that they aren’t aware of my efforts. Is this more of a shame for the space, me, or both? Do you think any of this can actually be rectified?

I’m saying that to pre-empt some of the most vacuum filled criticisms laid towards the substance of this article, so you wouldn’t have to deal with the arguments. Is it all coming from an upset point of view? Perhaps some. But if you would have been in the trenches for as long as I have, paid the price I have, and having to watch your favorite new thing make massive side-steps – can you blame me? I’m as in love with this space as you are, but it’s really starting to become a new almost one-sided thing.

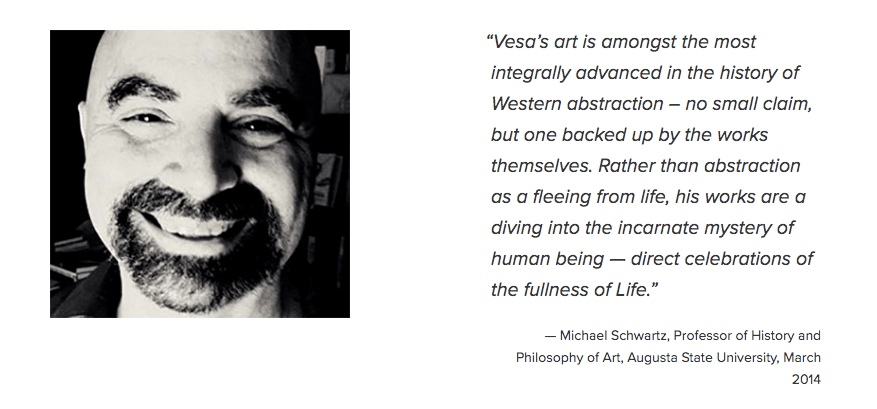

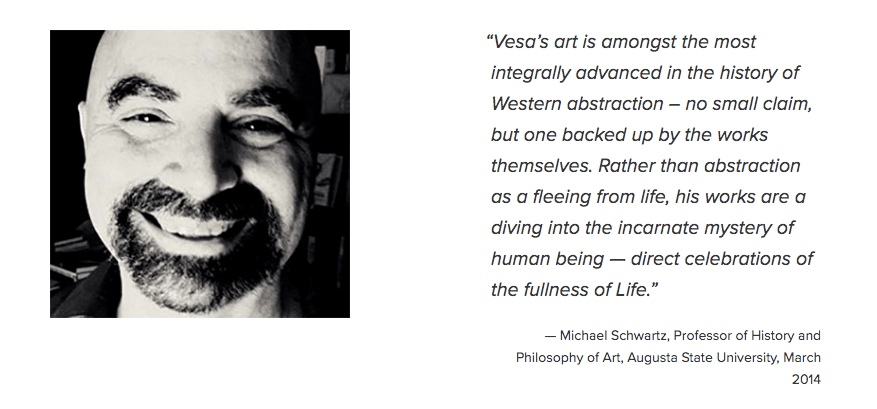

Please consider this to cap this off. What the above quote from the Integral Insititute feature from 2014 means, is that basically managed to integrate more expression, cultural significance, and innovation to my works that the biggest names in Western art history, now selling for hundreds of millions – as acknowledged by one of the rare professors left able to do the evaluation of that level. I also reached 300MM people with a project featured in that article due to its cultural impact. I climbed the heavyweight tallest mountain, only to find out almost no one cared. So this is all deeply personal, sure. You could say I’m furious at times.

So, what I am selling really?

No, seriously, I’m done writing culture.

No one paid me to do this.

I’m not claiming immunity to all things mentioned above.

Metaverse AND the Physical Space

I’m also building a physical studio space crossing over to the metaverse with the company Coloro. There are 9 of the 10 NFTs left to help support the build of it, now tokenized on Mintable. The link is to the second one, and this will soon get its own promotional article. The space in its raw form can be seen in this Brittany Kaiser interview with Hardforking, and if you want to further understand the NFT space, have a listen to this Encrypted episode with Ahmed recorded in Dubai a couple of weeks back.

Redemption digital art NFT for sale on Superrare

I think this article will age fairly well.

Stay cool, folks.

V E S A

Crypto Artist

Official Pages:

Crypto Art

Artevo Platform

Twitter Insta LinkedIn

from NewsBTC https://ift.tt/2KP3syZ

Find The best Lending Program

Top CryptocurrencyLending Program

Sure we are the beginning of a digital revolution, but it’s increasingly, ideas-wise, looking like old mediocre bullshit in a new wrapper celebrating the same old money hype – at the expense of its actual potential impact of liberating a whole class of creative people. This article is an attempt to raise the bar of the current conversation resolution in a culturally significant way, so it will undoubtedly ruffle some feathers.

Sure we are the beginning of a digital revolution, but it’s increasingly, ideas-wise, looking like old mediocre bullshit in a new wrapper celebrating the same old money hype – at the expense of its actual potential impact of liberating a whole class of creative people. This article is an attempt to raise the bar of the current conversation resolution in a culturally significant way, so it will undoubtedly ruffle some feathers.