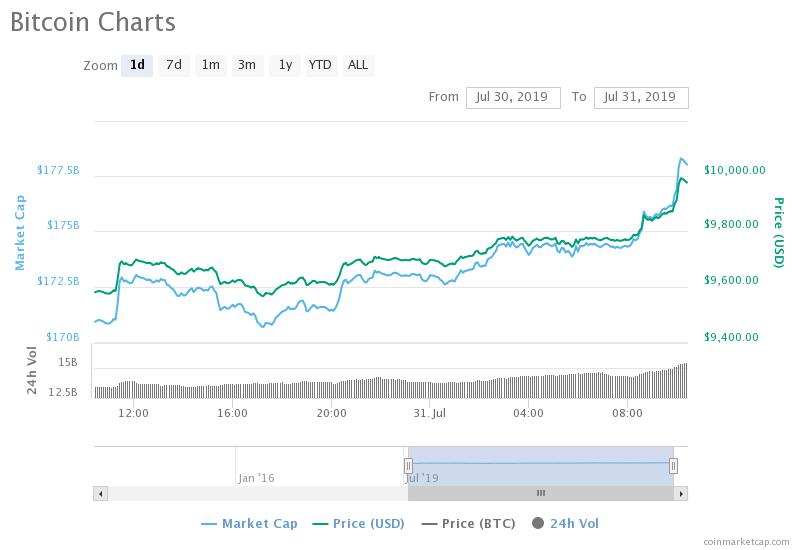

- Bitcoin price climbed higher recently and broke the $10,000 resistance area against the US Dollar.

- The price retested the $10,200 resistance area and it is currently correcting lower.

- There was a break below a short term ascending channel with support near $10,020 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The price is currently correcting lower, but dips remain supported near the $9,850 and $9,800 levels.

Recently, there was a nice upward move in bitcoin price above $10,000 against the US Dollar. BTC price retested the main $10,200 resistance level and it is currently correcting gains.

Bitcoin Price Analysis

Yesterday, we discussed the chances of more upsides in bitcoin price above $10,000 against the US Dollar. The BTC/USD pair did gain momentum above the $9,800 resistance and the 100 hourly simple moving average. Moreover, the pair broke the $10,000 resistance level and revisited the $10,200 resistance. A swing high was formed near $10,182 and the price is currently correcting lower.

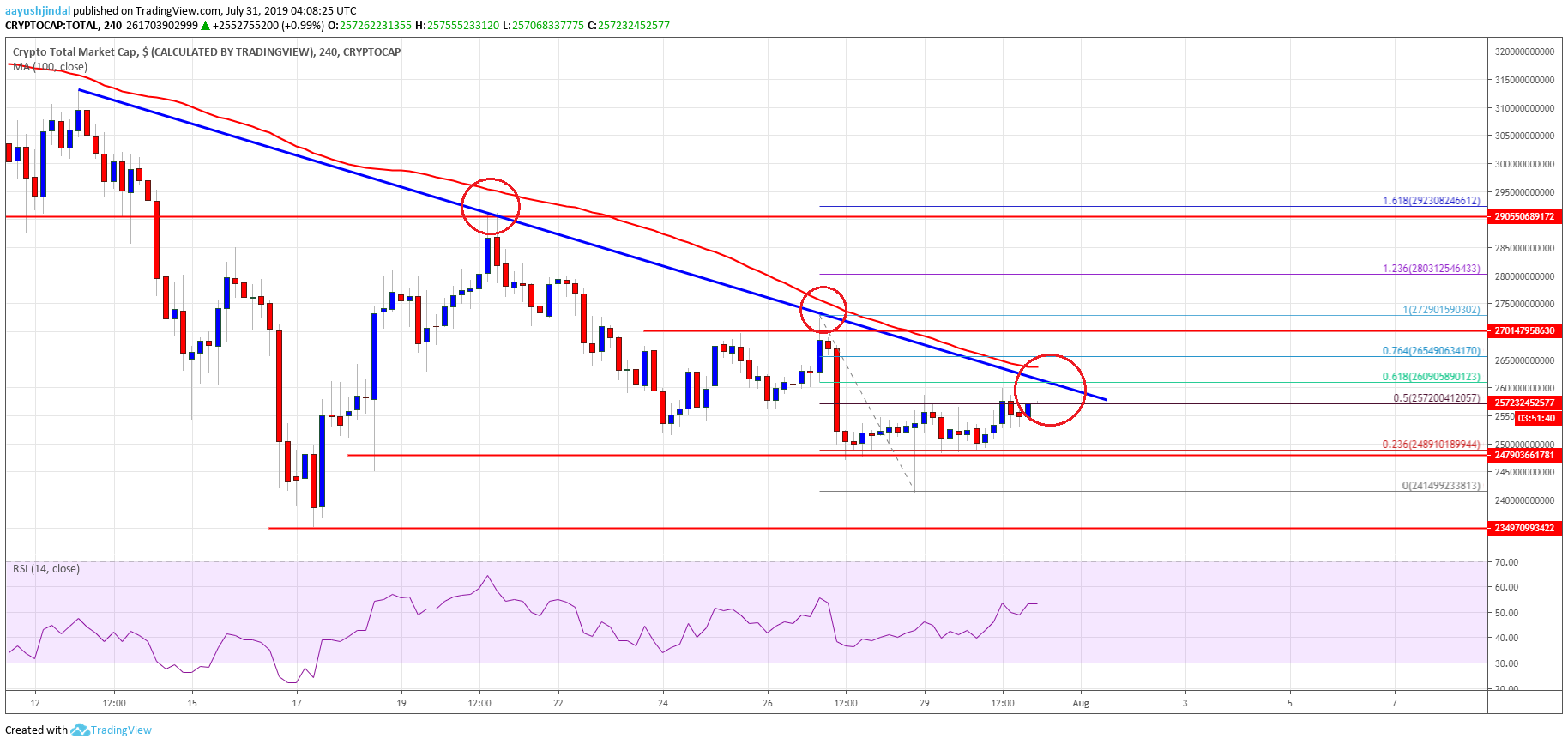

It traded below $10,100 plus the 23% Fib retracement level of the recent rise from the $9,645 low to $10,182 high. Moreover, there was a break below a short term ascending channel with support near $10,020 on the hourly chart of the BTC/USD pair. The pair is now trading near the $10,000 level, with an immediate support near the $9,940 level. Additionally, the next key support is near $9,910 plus the 50% Fib retracement level of the recent rise from the $9,645 low to $10,182 high.

The main support is near the $9,850 level. If there is a downside break below the $9,850 support, the price could revisit the $9,650 level. The 100 hourly SMA is also waiting near the $9,640 level. Any further losses might push the price towards the $9,300 zone. It represents the 1.236 Fib extension level of the recent rise from the $9,645 low to $10,182 high.

On the upside, an immediate resistance is near the $10,050 level, above which the price is likely to retest the $10,200 resistance level. Therefore, the bulls need to gain strength above the $10,180 and $10,200 resistance levels in the near term for further gains.

Looking at the chart, bitcoin price is clearly trading with a positive bias above the $9,900 and $9,850 levels. Conversely, if there is a fresh decline, the bulls are likely to protect the $9,640 support level. On the upside, a clear break above $10,200 will most likely set the pace for a move towards $10,500.

Technical indicators:

Hourly MACD – The MACD is slowly gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently declining lower towards the 50 level.

Major Support Levels – $9,910 followed by $9,850.

Major Resistance Levels – $10,050, $10,200 and $10,500.

The post Bitcoin Price (BTC/USD) Correcting Gains, Dips Remain Supported appeared first on NewsBTC.

from NewsBTC https://ift.tt/2KuvQT1

Find The best Lending Program Top CryptocurrencyLending Program

hit

hit (@KomandanteFrank)

(@KomandanteFrank)