Bitcoin is booming all over mainstream finance and throughout social media. Other cryptocurrencies are nearly as hot, and even meme stocks like GameStop, AMC, and others have brought retail into finance like never before. It also has uncovered some of the more unorthodox parts of finance, such as financial astrology.

Financial Astrology has been around for as long as markets have been trading but has recently become popular through the likes of Twitter and TikTok influencers. But not everyone is hopping on the trend. We’ve had the opportunity to sit down and speak to a pro in astrology who spent more than two decades learning the craft. They’re a leader in the field of financial astrology and technical analysis market timing and are here to explain how the innovative combo can be applied to Bitcoin, Ethereum, and other cryptocurrencies.

Interview With Financial Astrologer, Technical Analyst Crypto Damus

NewsBTC: Can you start with a short introduction on how you first became interested in financial astrology and how that journey began?

Crypto Damus: I had noticed many correlations between markets and astrology over the years and read an article in The Mountain Astrologer about the financial astrologer Ray Merriman. I subscribed to his reports for a few years and became inspired to create my own forecast report specifically for Bitcoin and Crypto.

What came first, an interest in astrology or finance? And where do Bitcoin and crypto come into the fold for you?

I had already been involved in astrology for many years before getting specifically into financial astrology. I got interested in Bitcoin in 2017 and was curious to see if I could bring astrology techniques to predict Bitcoin price movement and started a free report in late 2017. We had some success early on and went to a paid subscription in 2019. In 2019, we predicted the January market bottom in January and also the spring rally and June blow-off top-down to a ten-day period, months in advance, and also predicted the months-long summer/fall downtrend that followed. We also predicted the March 2020 sell-off, although not how severe it would be. Since then, we have successfully called many major market tops and bottoms. But we have made mistakes too, Astro TA is pretty new and I continue to learn, improve and refine my techniques.

What about Bitcoin do you believe in?

I believe Bitcoin is part of several larger trends. First, I believe Bitcoin is the first international world currency that transcends international borders and national currencies and central banks, this can help world commerce and bring people together and unify the world. Second, Bitcoin is part of the generational technological shift in global finance from a material value like paper money and Gold into a digital value. Third, Bitcoin and Crypto, in general, is clearly part of a larger generational shift in investing; clearly, Crypto is the new stock market for millennials and one of the best-performing assets in the world on a 5-7 timeframe. Bitcoin presents a generational investment opportunity.

Obviously, this is a lot further sweeping of a question, but what are some key points that cause you to believe so strongly in financial astrology and astrology in general?

This is a longer discussion but generally, I consider astrology to be a universal language that reveals the deeper nature of reality. The correlation of Astrology to world events and market movement is clear and compelling, the data we have is convincing, and we think astrology adds another component to trading and investing that combined with other types of analysis, can give an edge. For example, in Sept 2019, on Twitter and in my subscription reports, I predicted and warned my followers of a major global crisis in 2020 and recommended Gold specifically, which did very well in 2020. Unfortunately, we were correct and knowledge is power, knowing what’s coming can help you prepare. I can’t tell you how many people have told me they thought astrology was BS until they started following my analysis! When they see the astrology play out in market piece action, the correlations are undeniable.

How did you arrive at the Crypto Damus name?

LOL, well, it’s basically a play on the famous astrologer Nostradamus who was said to be able to accurately predict future world events.

Nostradamus

Why do you think there are some people so opposed to the idea that astrology can work?

There are a variety of complex reasons but it’s basically a symptom of closed-mindedness to something you don’t understand. I mean honestly, there is no rational reason why astrology works, you have to have a bit more open-mindedness to a more mystical perspective that all things are somehow interconnected. Today, we live in such a scientific, materialist paradigm where science and logic are highly valued and this creates a lot of closed-minded attitudes to more mystical, intuitive arts like astrology. I mean, I love science, but it’s not the only tool in the box. Astrology is such a unique language that many don’t understand and haven’t taken the time to understand and there is no way to “prove” astrology works. So many people simply reject astrology without actually genuinely investigating it for themselves. It’s like listening to someone speak Chinese and thinking it’s a bunch of gibberish simply because you don’t personally understand it. Also, I think there is a misconception that Astrologers believe the planets “cause” events to happen. In general, we look at it more as a language and as a study of energy pattern recognition and analysis. I offer a range of astrology education to help change this!

What are your thoughts on the rise of financial astrology influencers on Twitter and TikTok recently, ie: Maren? What impact are they having on the practice?

Social media in general is an amplifier for both information and disinformation, but if it’s used skillfully, it can be a great way to introduce people to astrology. I mean, generally, I think it’s positive because it gets people, especially the younger generation, interested in astrology. Millennials are very interested in astrology and also in Crypto, so it’s a natural fit. Also, Crypto people seem to be inherently a bit more open-minded in general and I think they are more open-minded to astrology. Maren specifically is quite controversial for a variety of reasons, (valid or not), and people either seem to love her or hate her. Maren kind of stormed into the Crypto world and got a lot of attention for the same work I had been doing for years, which was a bit annoying. On the other hand, she brought a lot of interest to financial astrology and more interest in my work as well. Some people don’t like it because she does a lot of videos in lingerie or whatever, but I think it’s different and unique. I’m friendly with her and I was on her Podcast in January, but I don’t actually follow her work closely. Overall, if she is reaching a younger audience, bringing more genuine interest to astrology, and helping people to understand astrology better, I think it’s a good thing.

Trading Bitcoin And How Technical Analysis Works With Astrology

How exactly do you leverage financial astrology within your own technical analysis?

It’s quite complex, but basically, we see astrology as another level of information that adds an edge to technical analysis and risk management. In one way, you can say that astrological factors are simply another technical indicator that helps us understand the market price action and trend. Astrology can also help with timing and risk management. For example, if you know a certain period is more or less favorable for trading, you can add or reduce risk accordingly. It sometimes helps with when to close a trade or take profits on a long-term position. But like any technical signal, it can give false signals too, so it’s just one factor we look at.

Has financial astrology ever predicted any correct market actions for you, and if so, can you provide some examples of that success?

I think I already gave you two examples from 2019 and 2020, however, we use them every day to help with swing trading, as well as long-term investing. I just recently accurately predicted the recent late July Bitcoin rebound rally to the day, based on Moon Phase data combined with technicals, and told our subscribers to add to long-term positions and go long at 30,600. We also use it to help assess Altcoins and have recommended LINK for several years and recently recommended ADA and BNB.

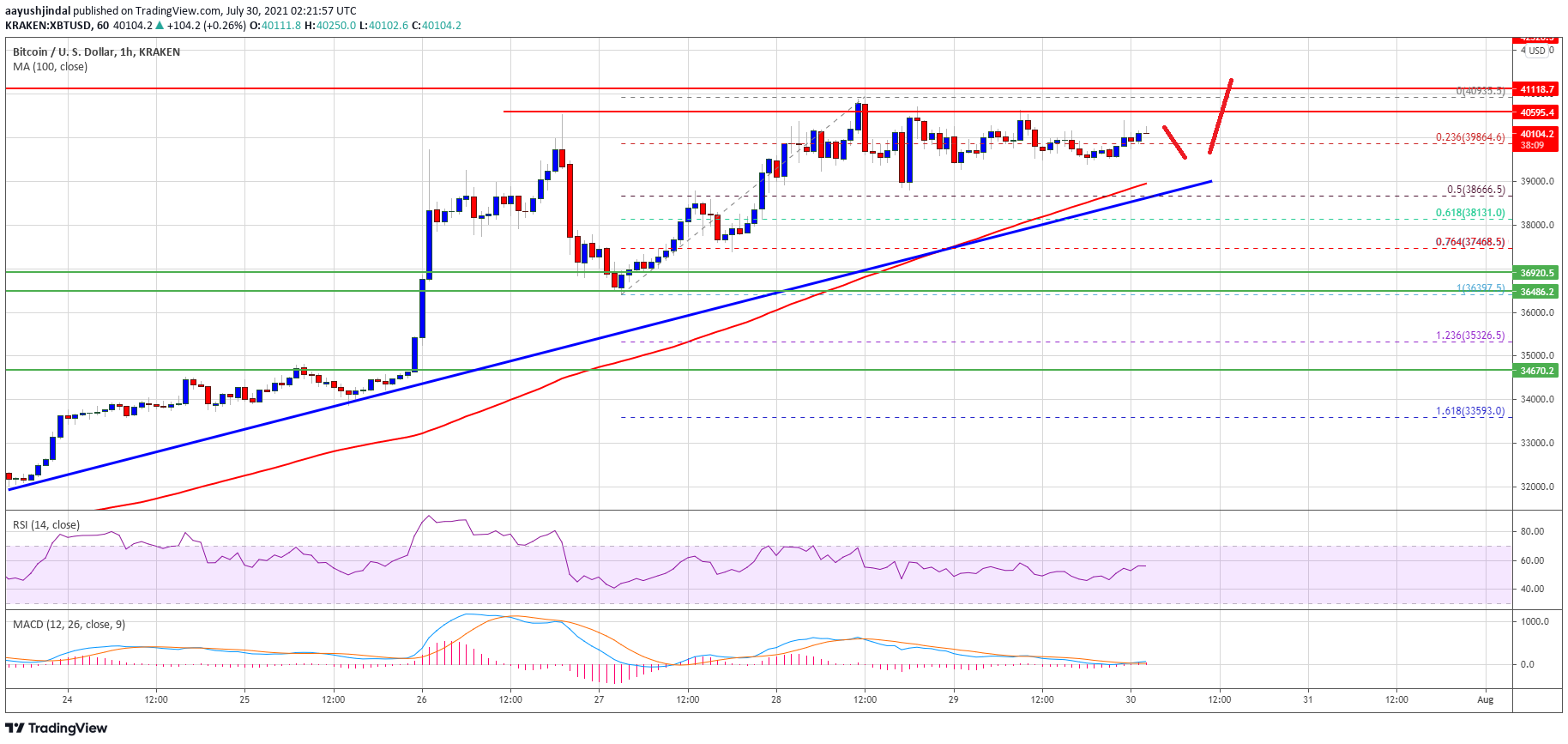

TA infused with astrology is the Crypto Damus way | Source: BTCUSD on TradingView.com

Bigger picture data from 1977, 2000, and 2008 indicates Stock Market rallies tend to top out in the middle of Uranus-Saturn hard aspects, followed by multi-year downtrends. We have a Uranus-Saturn square in 2021-’22, so we think the bull market in stocks could continue well into 2022 but likely tops out somewhere before OCT 2022, probably because the FED will have to raise rates.

Can you provide some examples of what, for example, Saturn conjunct with Mars might mean for Bitcoin?

Mars and Saturn are considered unfavorable planets, so when they come into conjunction, it’s generally considered “bad luck” and brings problems, conflicts, epidemics, and market corrections. Of course, Mars and Saturn can, in some cases, also be favorable depending on the aspect alignments.

How do you combine conventional technical indicators with financial astrology to develop a working system?

That is an ever-evolving thing. Right now, in short-term trading, we study the planetary aspect picture, the moon phase data, and transits and progressions in the Bitcoin natal chart and come up with a rough forecast picture for Bitcoin. I also use my own natal chart quite a bit. One of the mysteries of financial astrology is that your own natal chart will often provide the most accurate information and clues for your personal trades. I work with other trades to identify favorable and unfavorable periods for trading. Then we study support and resistance levels, use traditional technical indicators like RSI, MACD, and Stochastics, with daily and weekly moving averages, and set some technical criteria for entries, stop losses, and profit targets. So the astrology gives us a bear or bull bias on monthly and weekly time frames, then we use price action and technicals to confirm or invalidate our bias and also to manage the actual trades. We give all this info in our Patreon group and Substack reports.

Is there truth to things like Mercury in Retrograde, for example?

Yes, Mercury rules travel, technology and communication, so when it goes retrograde 3x a year for three weeks each time, these areas of like become more prone to problems. Technology in general and cars and phones and laptops more specifically seem to have more problems, or problems that have been brewing have to be dealt with. Also, travel is more prone to delays and interpersonal communication can break down. It’s generally discouraged to sign any long-term binding contracts at that time.

Related Reading | Mercury in Retrograde: Why Bitcoin Traders Fear The Astrological Event

But Mercury retro can also be good for certain things, like revising and editing, going through closets to de-clutter, returning to well-worn places, and visiting with an old friend you haven’t seen. It’s generally better for slowing down and re-thinking your approach rather than trying to push ahead too strongly or launch a big project. In this way, astrology helps us be more in sync with the natural energy patterns of life. In financial astrology, we often see whipsaw price action around Mercury retro and a change in the market trend, we can often see problems, hacks, and glitches at the major exchanges.

How about the sun and moon cycles? How do these behaviors impact markets?

Well, specifically in 2021, Bitcoin has made a remarkable correlation with Moon Phases. So far, we have seen Bitcoin price trend down from the New Moon into the Full Moon, making seven market bottoms just before or on the past seven Full Moons within 1-3 days. And then rally strongly from the Full Moon into the New Moon, making 5-7 tops on the New Moon period. It’s not exact, but it’s close enough to give you a general ballpark trend, and thus right now safer to trade long on the Full Moon and stay long into the New Moon and quickly flip short just before or on the New Moon. Now, this correlation could change, but for now, it’s been working.

And how can everyday individuals use astrology to better other areas of their lives outside of the financial world?

An astrology consultation from a professional astrologer can really provide profound insights into character and personality, career, relationships, and money. It’s a powerful path for self-knowledge. I give many consults to professional traders and investors looking for an edge. However, astrology can be useful in many different areas of life such as medical astrology, geolocation astrology, and relationship astrology, to name a few. Also following forecasts on general astrology can be very useful. As I mentioned, I and many other astrologers had predicted a major global crisis in 2020, and afterward that the Pandemic would continue well into 2021, so this type of information can be helpful to know in advance. Specifically, I predicted the Pandemic would improve May-July and worsen again in late July into late December, which sadly appears to have been accurate so far.

Financial astrology dates back ages and was highly popularized by W.D. Gann. Gann was equally considered a legend and a hoax due to the practices he claimed to rely on. What are your thoughts specifically on Gann?

To be honest, Gann was doing his own thing, with math and geometry, and other techniques. He did use astrological techniques but he is not really considered a financial astrologer per se. I get this question a lot but I haven’t studied Gann and don’t use his techniques, so I cannot provide any specific insights on this question

Are there any other worthy sources of financial astrology information? And how can the NewsBTC audience learn more about what you offer?

As I mentioned, Ray Merriman from MMA cycles is one of the leading financial astrologers in the field and does coverage of Stocks and commodities. Grace Stahre and my teacher Christeen Skinner are some others. For me personally, I have been the leader in the field of financial astrology specializing in Bitcoin and Cryptocurrencies. My Patreon group with 2-3x week updates for active traders can be located at https://www.patreon.com/CryptoDamus1 and all my info on subscription services, consults, education, and tutorials is on my website at www.astrocryptoreeport.com. I can be contacted at astrocryptoreport@gmail.com. You can also follow on Twitter at @AstroCryptoGuru.

Follow @TonySpilotroBTC on Twitter or via the TonyTradesBTC Telegram. Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com

from NewsBTC https://ift.tt/37nipjD

Find The best Lending Program

Top CryptocurrencyLending Program