Bitcoin price is trading in a bullish zone above the $11,600 support against the US Dollar. BTC is likely to gain strong momentum above $11,800 as long as it is above $11,550.

- Bitcoin is following a nice bullish path above the $11,550 and $11,600 support levels.

- The price is facing hurdle near $11,800, but it is well above the 100 hourly simple moving average.

- There is a crucial bullish trend line forming with support near $11,580 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair is likely to rally above $11,800 and $12,000 as long as it is above the $11,550 support.

Bitcoin Price Showing Bullish Signs

There was a strong positive move in bitcoin price above the $11,500 resistance against the US Dollar. BTC climbed above the $11,550 resistance and settled well above the 100 hourly simple moving average.

It traded as high as $11,784 and recently started a downside correction. There was a break below the $11,650 support, but the price remained well bid above the $11,550 support. A low is formed near $11,533 and the price is currently rising.

It broke the $11,650 resistance level to start a fresh upward move. The bulls were able to push the price above the 50% Fib retracement level of the recent decline from the $11,784 high to $11,533 low.

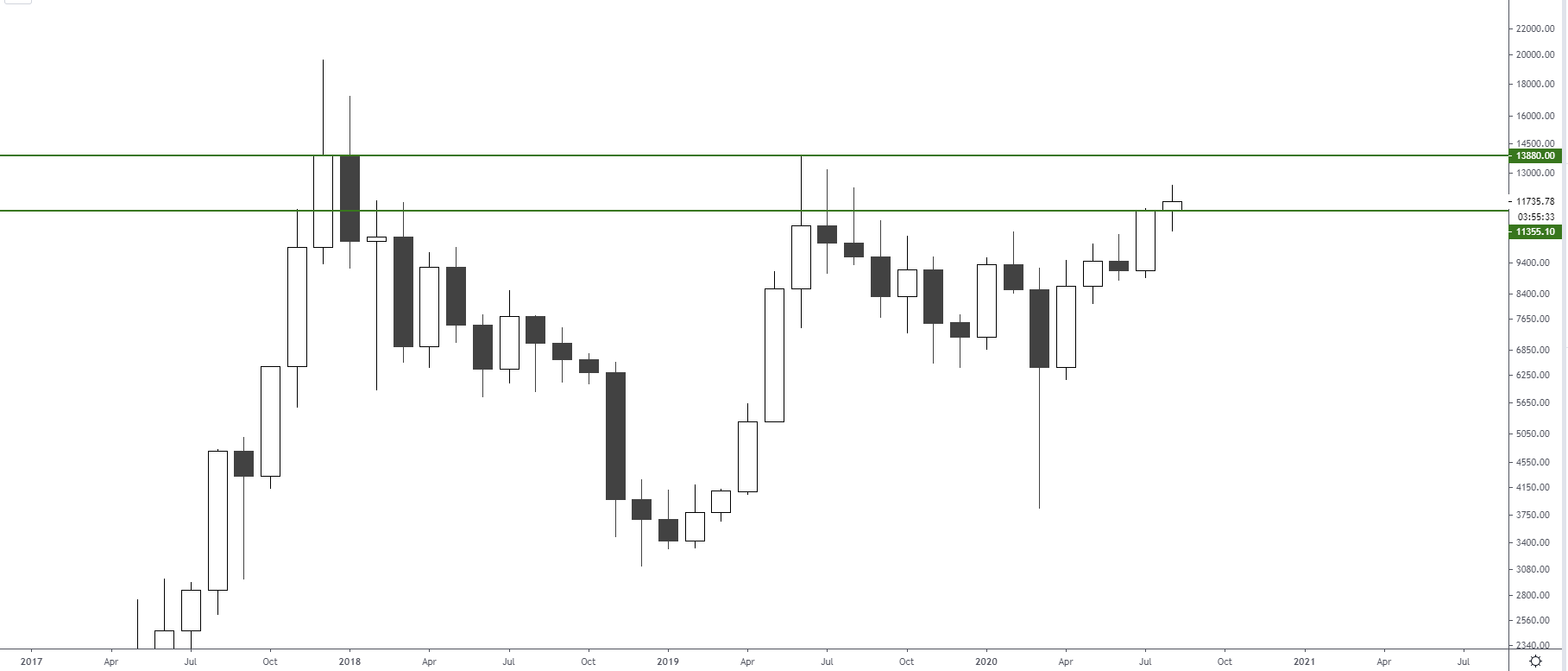

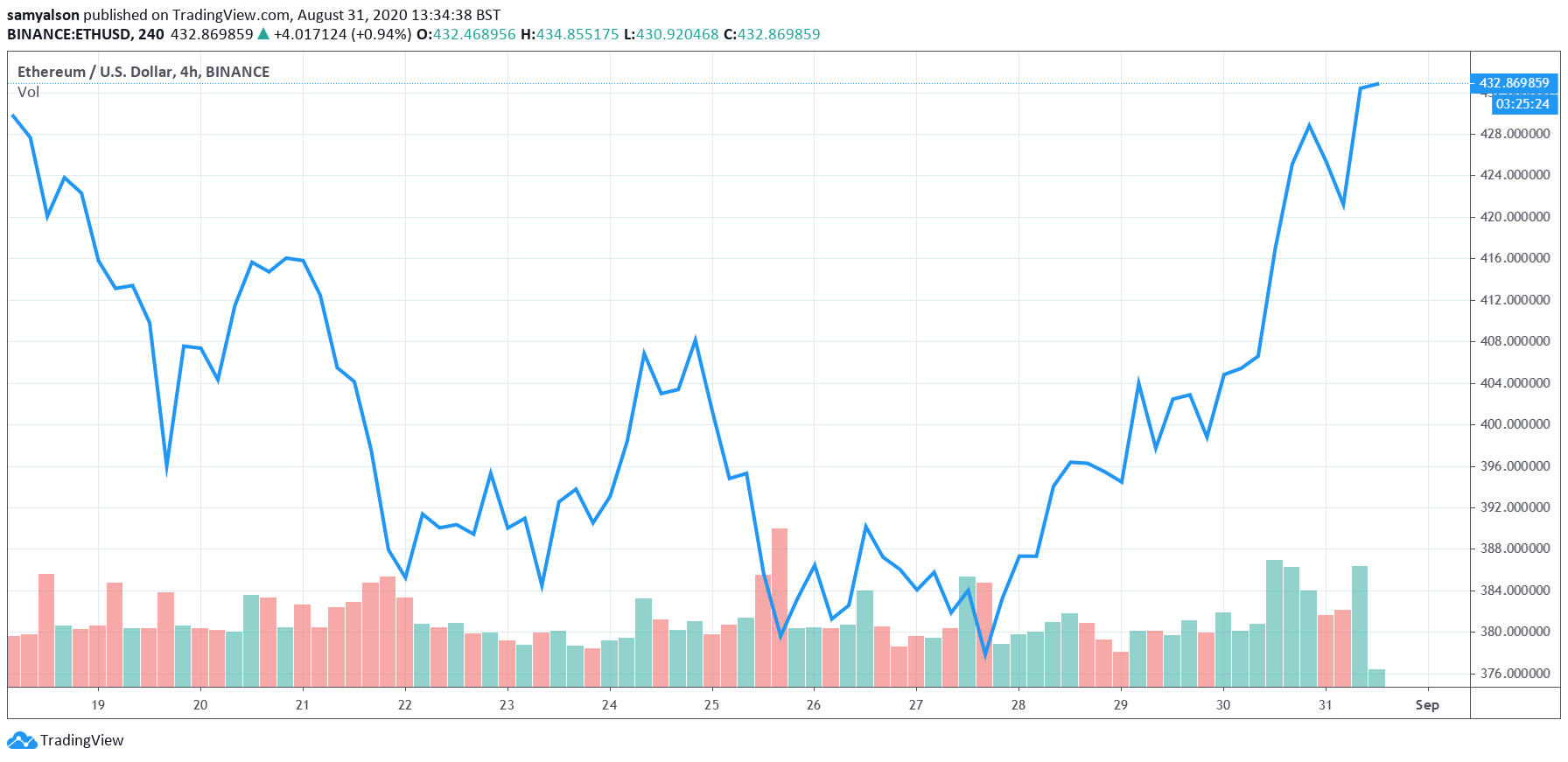

Bitcoin price trades above $11,600. Source: TradingView.com

It seems like there is a crucial bullish trend line forming with support near $11,580 on the hourly chart of the BTC/USD pair. An immediate resistance on the upside is near the $11,725 level. It is close to the 76.4% Fib retracement level of the recent decline from the $11,784 high to $11,533 low.

If bitcoin climbs above the $11,725 resistance, it is likely to break the recent high and the $11,800 resistance. The next key resistance on the upside is near the $12,000, above which the price is likely to accelerate higher.

Dips Supported in BTC?

If there is no upside break above the $11,800 resistance, bitcoin price might correct lower. An initial support is near the trend line and the $11,600 level.

The main support is still near the $11,550 and $11,500 levels, below which the price is likely to move into a short-term bearish zone.

Technical indicators:

Hourly MACD – The MACD is now gaining momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is rising and it is above the 50 level.

Major Support Levels – $11,600, followed by $11,550.

Major Resistance Levels – $11,800, $11,850 and $12,000.

from NewsBTC https://ift.tt/2YTDm1v

Find The best Lending Program Top CryptocurrencyLending Program