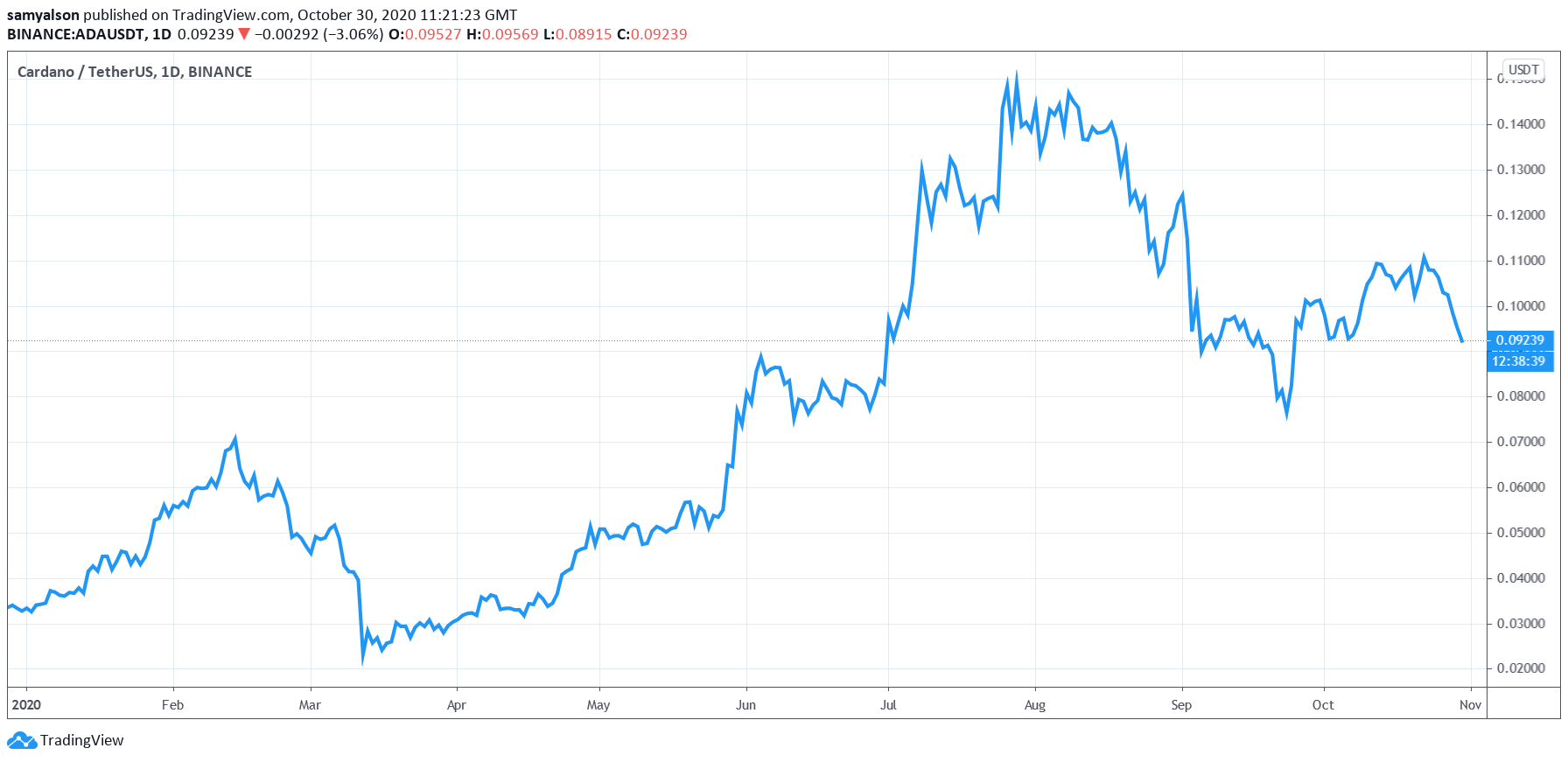

Ethereum struggled to continue higher and declined below $400 against the US Dollar. ETH price is consolidating losses and it must surpass $395 for a fresh rally.

- ETH price corrected lower below the $400 and $392 support levels against the US Dollar.

- The price is trading near the $385 zone and the 100 simple moving average (4-hours).

- There is a major bearish trend line forming with resistance near $395 on the 4-hours chart of ETH/USD (data feed via Kraken).

- The pair is likely to rally if it clears the $392, $395 and $396 resistance levels.

Ethereum Price is Facing Key Hurdles

This past week, Ethereum started a downside correction from well above $400 against the US Dollar. ETH price even traded below the $392 support level and the 100 simple moving average (4-hours).

A swing low was formed near $373 and ether price started an upside correction after bitcoin’s sharp increase towards $14,000. There was a break above the $380 and $382 levels. The price even climbed above the 23.6% Fib retracement level of the downward move from the $410 high to $373 low.

However, the price seems to be facing a strong resistance near the $392 level. It is close to the 50% Fib retracement level of the downward move from the $410 high to $373 low.

Source: ETHUSD on TradingView.com

The next major resistance is near the $395 and $396 levels. There is also a major bearish trend line forming with resistance near $395 on the 4-hours chart of ETH/USD. A successful break above the $392, $395 and $396 resistance levels is must to start a fresh rally in the near term.

The next resistance is near the $400 level, above which the bulls are likely to aim a retest of the $420 resistance zone in the coming sessions.

More Downsides in Ether (ETH)?

If Ethereum fails to clear the $392 and $395 resistance levels, it might start a fresh downside correction. An initial support on the downside is near the $382 level.

The main support is forming near the $373 low. Any further losses could lead the price towards the crucial $365 support (a multi-touch zone).

Technical Indicators

4 hours MACD – The MACD for ETH/USD is struggling to gain momentum in the bullish zone.

4 hours RSI – The RSI for ETH/USD is currently just below the 50 level.

Major Support Level – $382

Major Resistance Level – $395

from NewsBTC https://ift.tt/3ehn2Os

Find The best Lending Program Top CryptocurrencyLending Program