You may have heard the murmurs about AIOZ Tube, the new streaming site backed by blockchain disruptors at Innovion and the PAID Network. If you’ve gone further, and had an opportunity to check out the platform, you’ll have seen the top-tier crypto, trading, investment and personal finance videos, or seen some of its user-created content pop up on your social feed.

Maybe you’ve picked up some snippets about its decentralized streaming model, which delivers videos faster, and with higher visual and audio quality, by incentivizing node operators to participate. Or perhaps you’ve simply heard that AIOZ promises a new business model for content streaming, in which users actually earn income by watching videos.

(And if you’ve yet to discover AIOZ – jump over to watch a few videos on the platform, earn yourself a few coins in the process, then come back for the rest of this article. Go ahead. We’ll wait.)

Whatever you’ve heard, AIOZ is even more impressive once you put the full story together.

Unpacking the Tech and Team Behind AIOZ Tube

The team at AIOZ Tube has put together a Layer 1 blockchain-based Content Delivery Network (CDN) that matches or beats the establishment services like YouTube or Vimeo while offering all participants and stakeholders a share of the profits.

In essence, not only do you get a better content streaming service, but you’re also rewarded and incentivized to participate as a content creator, viewer, advertiser, or node operator.

AIOZ Tube is a content streaming platform that empowers users to earn coins by watching their favorite videos and content makers. A portion of advertising revenue that goes through the platform is directed to users; when you watch a video with an advertisement, you earn a reward. If you don’t want to watch an advertisement and don’t care about a reward, simply skip it.

It’s a deceptively simple idea, but a powerful one. The platform’s users reclaim the value that they provide and are compensated for their time and attention, while advertisers benefit from a more engaged, targeted audience.

That up-ends the traditional content streaming business model, in which viewers are turned off by the obstacle (advertisement) that prevents them from accessing the content that they want, and advertisers are paying for useless traffic while actively damaging their brand.

For content creators, AIOZ is a compelling proposition. It’s no secret that musicians, vloggers, and content creators of all stripes are constantly complaining about streaming platforms’ opaque and unfair revenue-sharing models, censorship, and other forms of poor treatment. Everyone from Taylor Swift to Logan Paul has had a run-in with YouTube, Spotify, or another legacy streaming platform. But until now, there have been few alternatives.

Today, however, content creators on AIOZ can access a fairer revenue share, more control of their content, and better infrastructure for distribution.

What’s the Big Picture?

The entire AIOZ Tube platform is powered by a blockchain-based decentralized CDN, which means that all the information storage and processing is handled by node operators. These node operators are everyday network participants who run the AIOZ app in the background on their home computer (and get paid for their spare computing capacity and bandwidth). The AIOZ Network means no more buffering videos or sluggish servers, no more ridiculous charges from the big CDN operators, and no more censorship.

Cisco has predicted that video streaming and telemeetings will make up 82% of internet traffic by 2022 (although that prediction was made before COVID-19 put streaming into overdrive). But the vast majority of that traffic is funneled through just three big CDNs – Cloudflare, Amazon Web Services, and Akamai.

Video streaming has become essential to the worlds’ entertainment, education, and employment, and squeezing it through a couple of centralized legacy companies has any number of risks and drawbacks. For a start, it’s terrible value for money: distributed infrastructure is faster, cheaper, more efficient and more agile than relying on a handful of big data centers.

It’s also safer to spread out information centres and distribution pathways. A decentralized CDN has many more attack vectors, but also much more redundancy than a centralized one. To put it plainly, a decentralized CDN like AIOZ is much more difficult to hack, censor, shut down, or simply overwhelm. That means less downtime and greater privacy and security for the end-users.

But the biggest benefit of AIOZ’ decentralized CDN is that it’s simply fairer. There’s no reason why a couple of mega-corporations should command so much of the internet, and collect so much of its profit, simply by virtue of sitting in an entrenched position.

AIOZ Network is offering a framework for disrupting and democratizing the internet, handing back true control (and a profit share) to the content creators and viewers who actually use it. If they can pull it off, it’s a revolutionary proposition – and for those who get in early, potentially a very lucrative one.

What’s Next for AIOZ?

In 2021, the AIOZ ecosystem will be fleshed out with fungible and non-fungible tokens, smart contracts and a decentralized exchange. Further down the pipelines, developer kits and an API should enable distributed apps (dApps) like over-the-top media services, as well as live-streaming. In short, there’s plenty more on the way from AIOZ, which promises to reimagine content streaming from the ground up.

Image by StockSnap from Pixabay

from NewsBTC https://ift.tt/3cDdOwZ

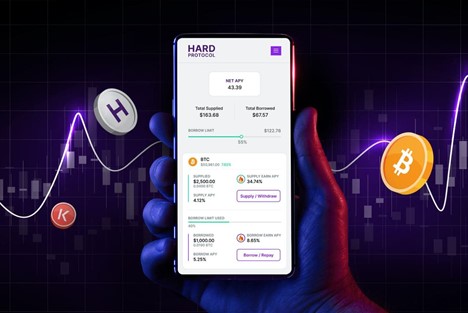

Find The best Lending Program

Top CryptocurrencyLending Program