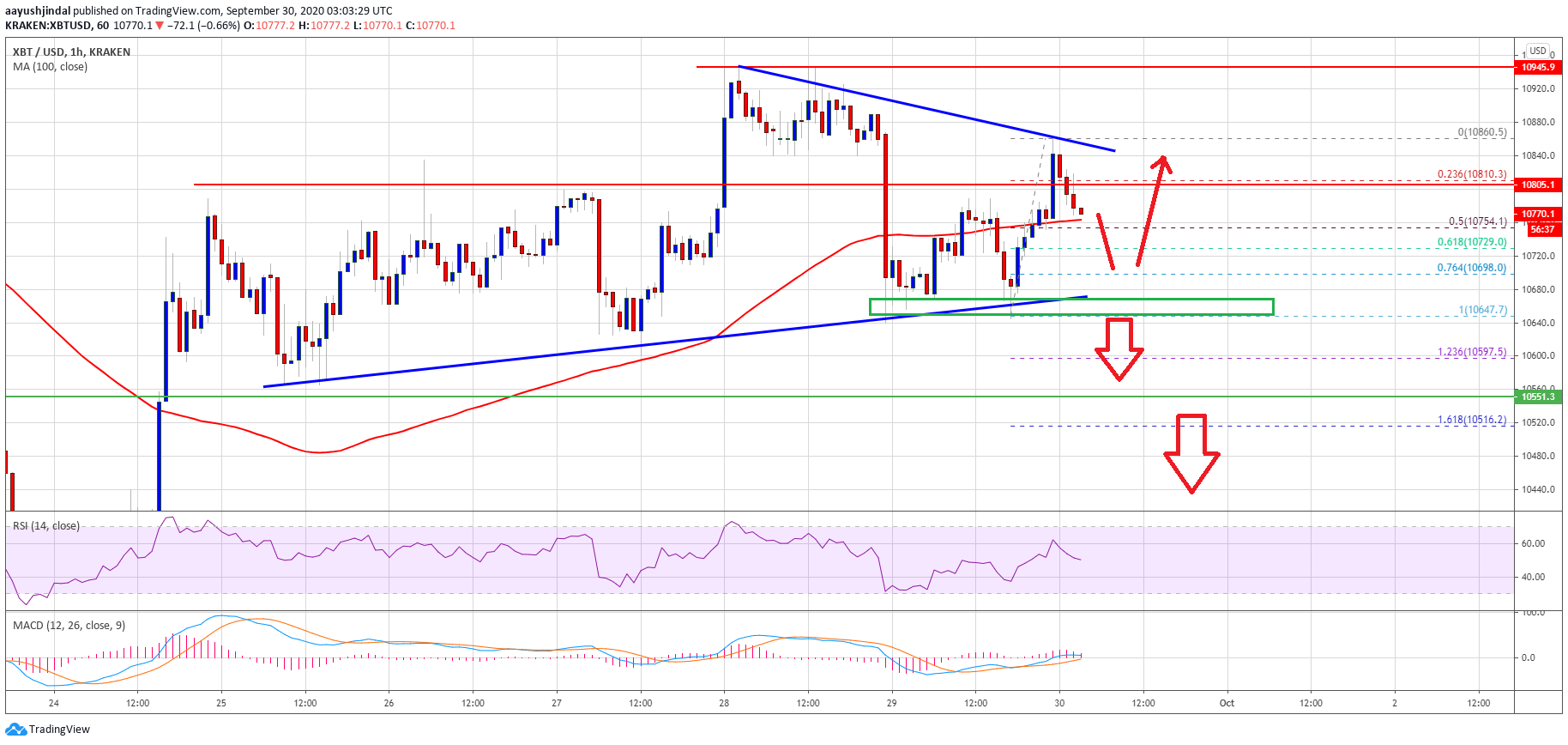

Bitcoin price is showing early signs of a bullish break above $10,800 against the US Dollar. BTC could continue higher as long as it is above the 100 hourly SMA.

- Bitcoin is struggling to gain bullish momentum, but it slowly moved above the $10,800 resistance.

- The price is now above the 100 hourly simple moving average, with a major hurdle at $10,920.

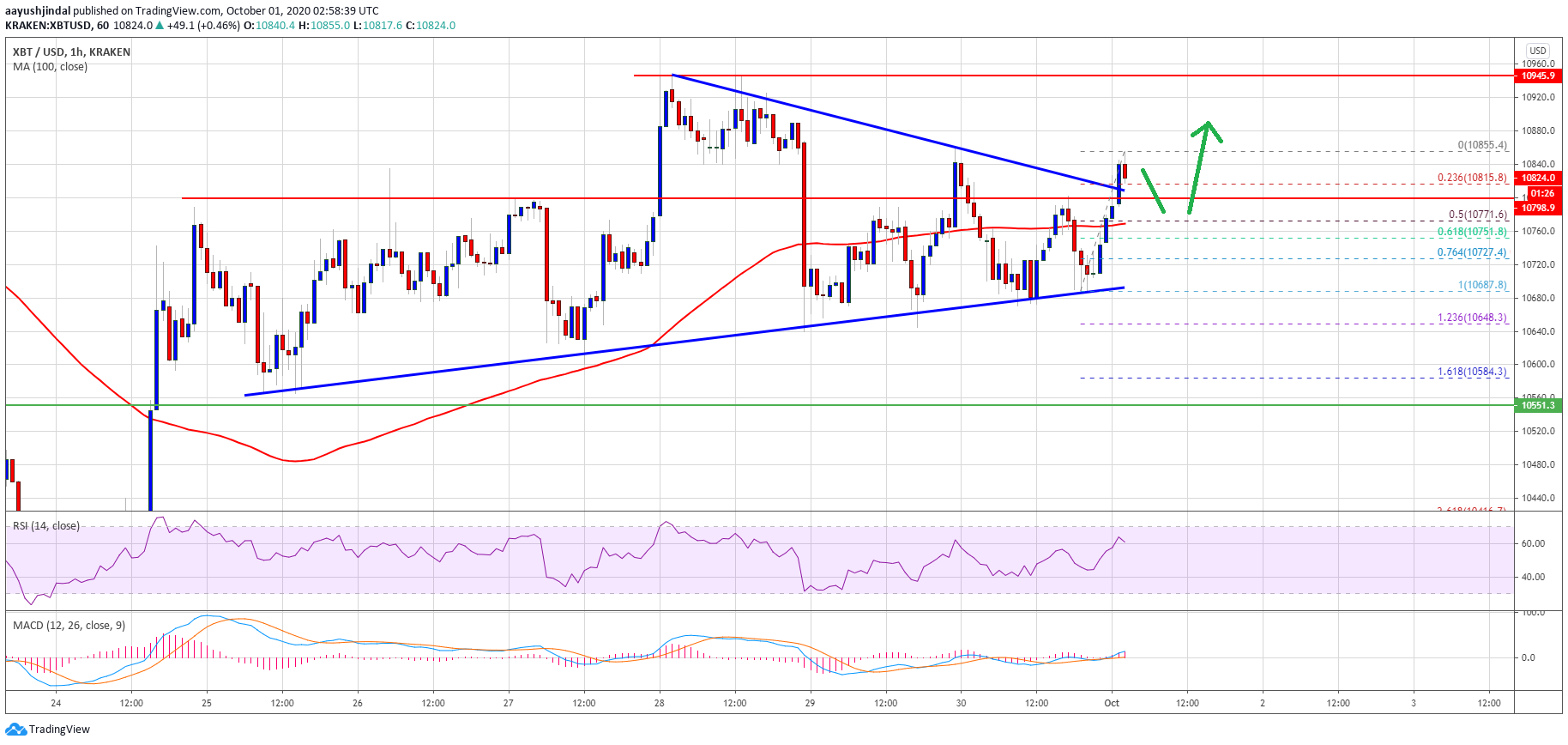

- There was a break above a crucial contracting triangle with resistance near $10,815 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise towards $11,000 as long as it is above the 100 hourly SMA.

Bitcoin Price is Showing Positive Signs

After multiple tests of the $10,650 support, bitcoin price started an upward move against the US Dollar. BTC was able to climb above the $10,750 and $10,800 resistance levels.

The upward move was such that there was a close above the $10,800 level and the 100 hourly simple moving average. More importantly, there was a break above a crucial contracting triangle with resistance near $10,815 on the hourly chart of the BTC/USD pair.

Bitcoin price is currently struggling to gain bullish momentum above $10,850 despite the recent upside break. A high is formed near $10,855 and the price is currently correcting lower. It is testing the 23.6% Fib retracement level of the recent wave from the $10,687 low to $10,855 high.

Bitcoin price trades above $10,800. Source: TradingView.com

The first key support is near the broken trend line at $10,800. The main support is near the $10,775 level or the 100 hourly simple moving average. It is close to the 50% Fib retracement level of the recent wave from the $10,687 low to $10,855 high.

As long as the price is above the 100 hourly SMA, it could resume its upward move. An initial resistance is near the $10,855 high. The first key resistance is near the $10,920 and $10,950 levels. The main resistance is still near the $11,000 resistance, above which the bulls are likely to take control.

False Break in BTC?

If bitcoin fails to continue higher above $10,855 or $10,950, the recent break could turn out to be a false move. A downside break below the 100 hourly SMA could lead the price below $10,750.

The main support is likely forming near the triangle lower trend line at $10,680. A successful break below the trend line support and $10,650 may perhaps increase the chances of a bearish break below $10,550.

Technical indicators:

Hourly MACD – The MACD is showing a few positive signs in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently well above the 50 level.

Major Support Levels – $10,770, followed by $10,680.

Major Resistance Levels – $10,850, $10,950 and $11,000.

from NewsBTC https://ift.tt/33hJGm8

Find The best Lending Program Top CryptocurrencyLending Program

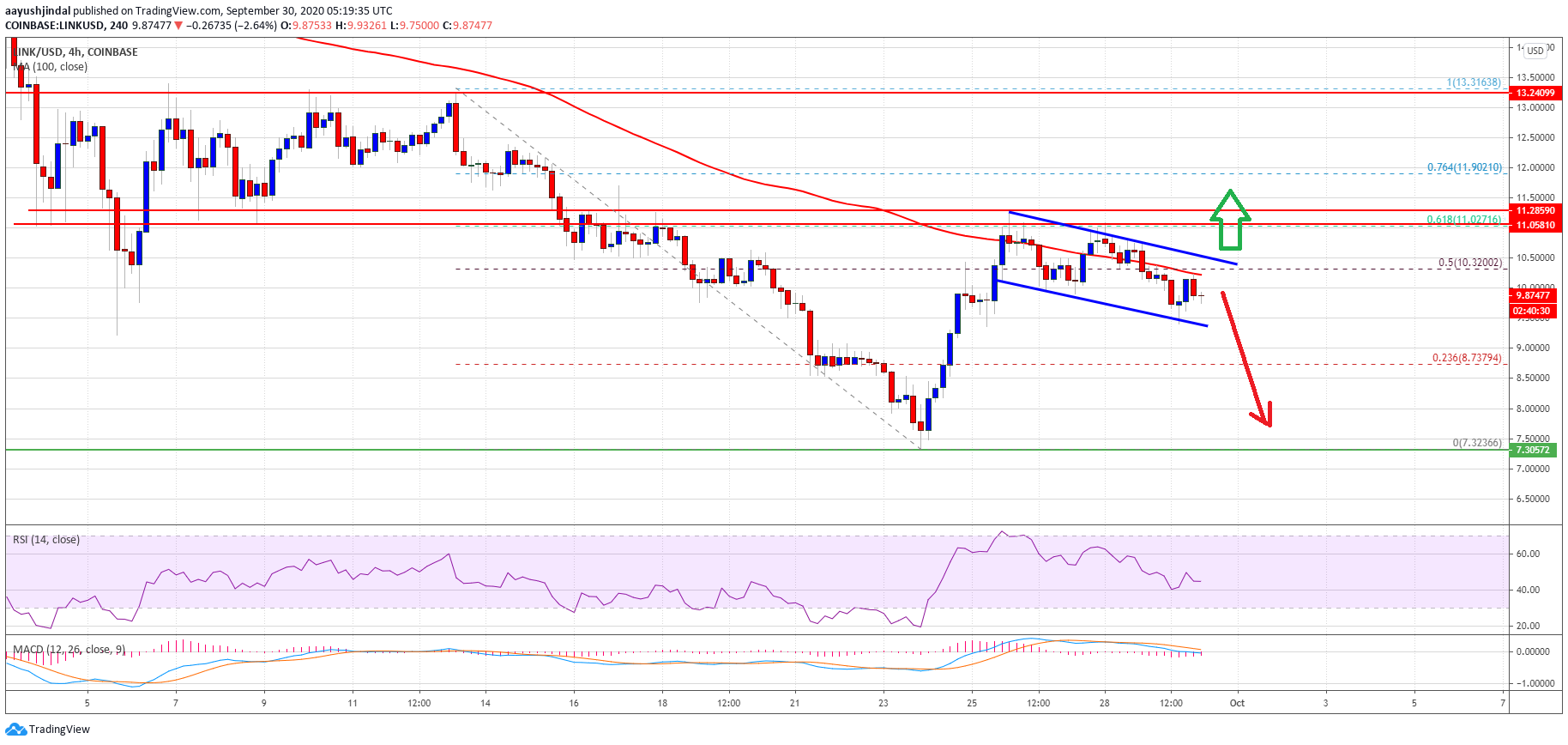

LINKBTC Parabolic Curve Holding Support | Source:

LINKBTC Parabolic Curve Holding Support | Source: