Ethereum has plunged below $1.3k today, but the decline may not be over quite just yet as on-chain data shows selling pressure continues to rise in the market.

Ethereum Exchange Inflows Have Continued To Go Up During The Past Day

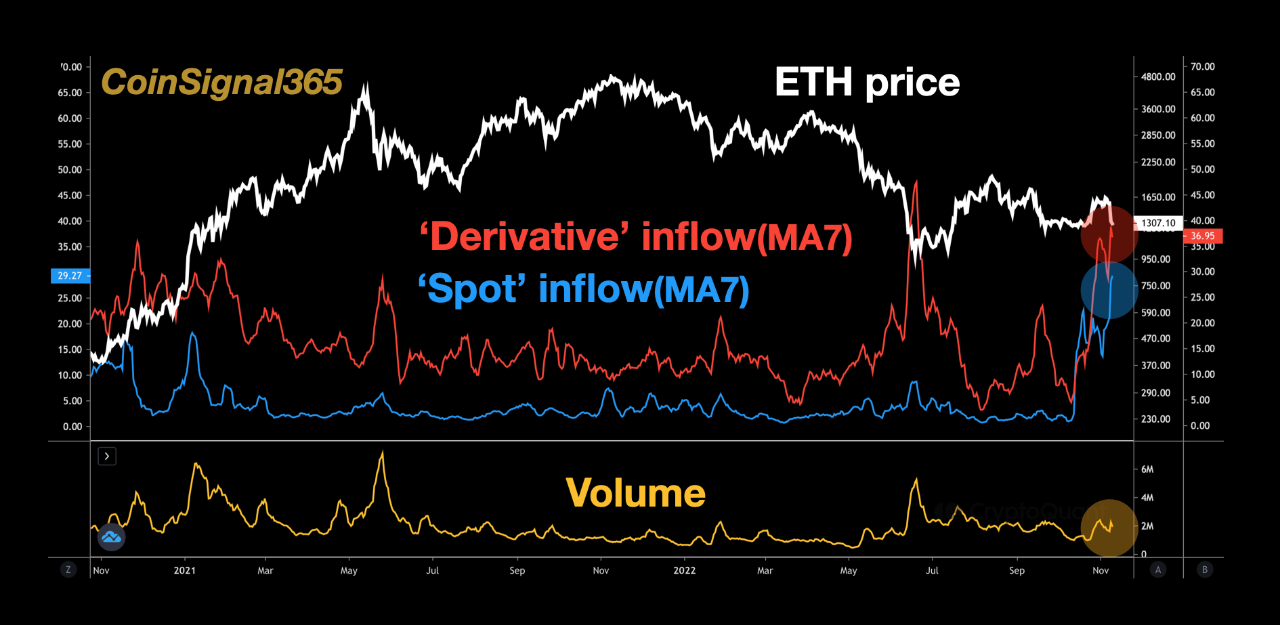

As pointed out by an analyst in a CryptoQuant post, the ETH derivative and spot exchange inflows are both still on the rise.

The “exchange inflow” is an indicator that measures the total amount of Ethereum entering into the wallets of centralized exchanges.

There are two versions of this metric, the first notes the inflows specifically going to derivative exchanges, and the other registers only those transfers that are moving to spot exchanges.

Generally, a rise in the derivative inflows leads to higher volatility in the market, as it implies that new futures positions are opening up, and leverage is increasing.

Spikes in the spot inflows can have direct bearish effects on the price of the crypto as investors usually deposit to these exchanges for selling purposes.

Now, here is a chart that shows the trend in both the Ethereum exchange inflow indicators (7-day moving averages) over the past year:

As you can see in the above graph, the Ethereum exchange inflows (both types) spiked up just before the crash shook the market.

In this latest drawdown in the price, the crypto has gone from $1.6k all the way down to just $1.2k over the last couple of days.

The main spark behind this crash seems to have been the battle between FTX and Binance, which has come to an end with Binance moving to acquire FTX.

However, it looks like the inflows still haven’t cooled off yet. Rather, the indicators seem to be actually climbing up even more.

This suggests that Ethereum is continuing to experience selling pressure, a sign that the current level may not be the bottom, and the crypto’s value might observe further decline in the coming hours.

ETH Price

At the time of writing, Ethereum’s price floats around $1.2k, down 21% in the last week. Over the past month, the crypto has dropped 8% in value.

Below is a chart that shows the trend in the price of the coin over the last five days.

from NewsBTC https://ift.tt/hBuL1He

Find The best Lending Program Top CryptocurrencyLending Program

Tidak ada komentar:

Posting Komentar