DeFi liquidity project MoonSafe is caught in a sea of controversy at present. Not only do prominent crypto personalities allege the project is a scam, but an analysis of its code by Obelisk reveals misleading claims about how liquidity provider (LP) tokens are secured.

LP tokens are minted and sent to the liquidity provider’s address as evidence of providing liquidity. They have utility and value and are often used to yield farm and therefore multiply gains from the initial act of providing liquidity. However, according to research by Obelisk, MoonSafe LP tokens are accessible by the founders.

“One of the main issues with the whole project is that while users are lead to believe that the Liquidity Provider tokens (essentially the receipt for having provided liquidity) are in fact locked and inaccessible from the founders, the exact opposite happens.”

Suspicions Over MoonSafe Heighten

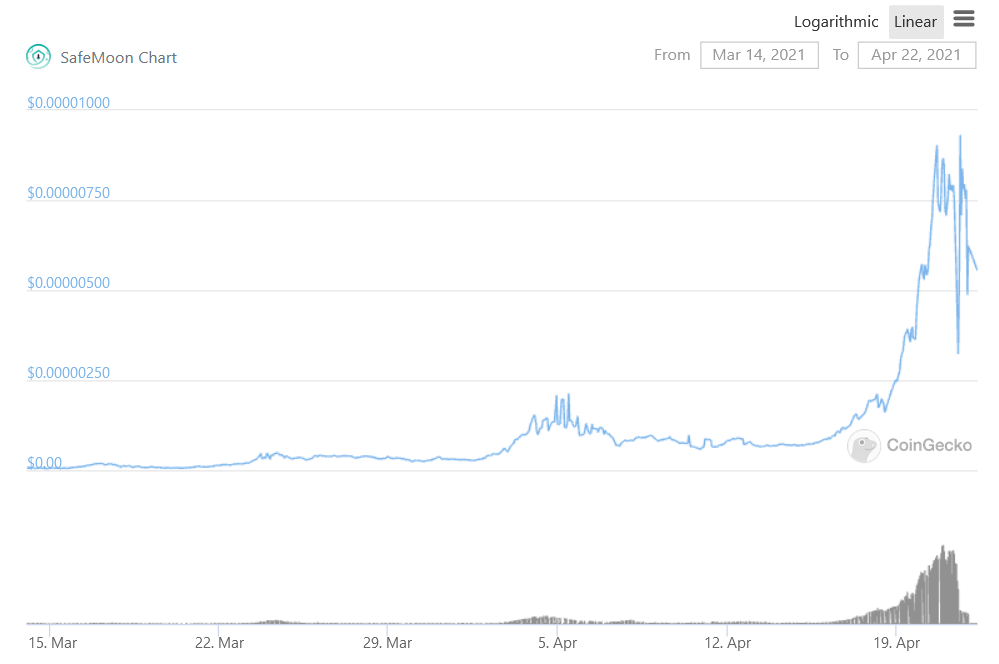

MoonSafe gains since its inception hit 11,500% at its peak. But a series of events have since tanked its price. The primary concern relates to allegations that the project is a rug pull, only to line the founders’ pockets.

Source: MOONSAFEUSD on coingecko.com

A whitepaper review highlights several inconsistencies, such as vague statements on the lock and burn process and other red flags, including a roadmap that doesn’t go beyond 2021.

“SafeMoon was advertised as “anti-rugpull” and as having its liquidity locked for 4 years… And to this day the website of the project remains very ambiguous as to how the locks and burns happen.”

Obelisk audited the MoonSafe code, which revealed more reasons to be wary. They allege fees for providing liquidity are directed to a wallet controlled by the developer. To address this, Obelisk recommends included an additional step to divert those funds to a smart contract with predefined community-centric functions.

“To mitigate risks, SafeMoon ownership could be transferred to a smart contract that could be programmed to handle funds securely only using predefined functions. This would be a particularly important factor in terms of security and trustlessness.”

Of more significant concern is the level of control held by the devs in terms of setting the percentage amount of fees of each transaction. Meaning, it’s possible to set the fees they receive, from users adding liquidity, to 100%.

Obelisk states that their code review shows a scenario conducive to a rug pull.

“This is particularly worrisome as the developers could essentially pull out the liquidity and market sell against any other liquidity provider with the coins that they had received from reflection fees from users. This is the perfect conditions to pull the rug under the users feet.”

CEO Describes Last Night’s AMA as a “Shambles”

In an attempt to address community concerns, MoonSafe developers hosted an AMA on Twitch last night. The video has since been deleted, and by the looks of it, so has the company’s Twitch channel.

Social media comments describe it as a farce. One Reddit user said the firm failed to address any of the concerns community members have.

“So the developers just held AMA where nothing was answered except they had a rapper there who talked about Porsches.”

CEO John Karony described the AMA as a shambles and opted to go live himself. But it’s unclear where that event took place, or even if it happened.

from NewsBTC https://ift.tt/3tJbGtx

Find The best Lending Program Top CryptocurrencyLending Program

Tidak ada komentar:

Posting Komentar