Market participants are becoming overwhelmingly concerned about a 22,000 BTC transaction that was made by the perpetrators of the PlusToken Ponzi scheme. The last time the individuals behind this scam moved such a significant number of tokens were back in mid-February.

During that time, roughly 12,000 BTC, worth $117 million, was transferred to an unknown address associated with mixer deposits. Following the transaction, Bitcoin peaked at a high of $10,500 and entered a downward trend that saw its price drop by nearly 70%.

Ergo, an on-chain data analyst, had previously noted that there is a strong correlation between the price of Bitcoin and PlusToken’s selling of coins.

For this reason, some of the most prominent analysts within the industry, including the head of DTC Capital Spencer Noon, believe that the most recent transaction by PlusToken could lead to a market crash. But is it realistic?

Bitcoin Prepares for a Major Price Movement

Different on-chain metrics support the idea the flagship cryptocurrency prepares for a significant downward impulse. The percentage of active coins, for instance, is currently declining while prices remain stagnant within a narrow trading range.

The last time this divergence between active tokens and price developed was in November 2018, which lead to a 50% correction. Bitcoin went from trading around $6,500 to approximately $3,200.

The Percentage of Active Bitcoin Declines Over Time. (Source: Santiment)

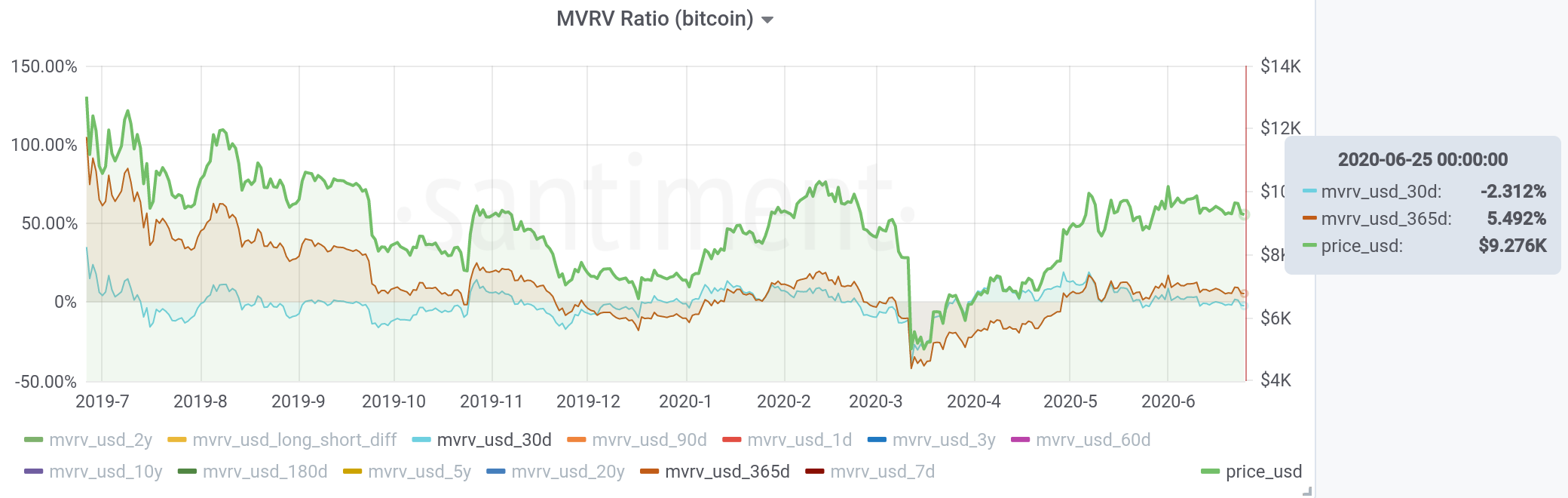

Moreover, the 30-day Market-Value-to-Realized-Value (MVRV) is currently hovering at critically low levels. This can indicate that those who purchased Bitcoin over the last 30 days are currently down 2.3% on their initial investment.

Meanwhile, the 365-day MVRV is “higher and closer to the danger zone,” affirmed Santiment. The behavior analytics platform maintains that historically long-term holders tend to close their positions around the current levels and begin to take profits triggering a downward impulse.

Bitcoin's MVRV Ratio Favors the Bears. (Source: Santiment)

An Ambiguous Outlook

With this in mind, the ascending triangle that has been developing on Bitcoin’s 12-hour chart over the past two months might break to the downside. Moving past the hypothenuse of the triangle will invalidate any bullish outlooks and present an opportunity for sidelined investors to get back into the market.

Under such conditions, the downswing could trigger a sell-off that pushes Bitcoin to $7,700 or lower upon the breakout point.

Bitcoin Is Contained Within an Ascending Triangle. (Source: TradingView)

It is worth mentioning that breaking above the overhead resistance at $10,000 will make the bearish scenario out of the question. If this were to happen, a state FOMO among investors may be triggered. That would allow Bitcoin to rise towards $12,000 based on the technical pattern shown above.

Due to the ambiguity of the market, it remains to be seen whether support or resistance will break first.

Featured Image from Shutterstock Price tags: btcusd, xbtusd, btcusdt Bitcoin's Network Activity Declines Suggesting Major Price Movement

from NewsBTC https://ift.tt/2NzlgvU

Find The best Lending Program Top CryptocurrencyLending Program

Tidak ada komentar:

Posting Komentar