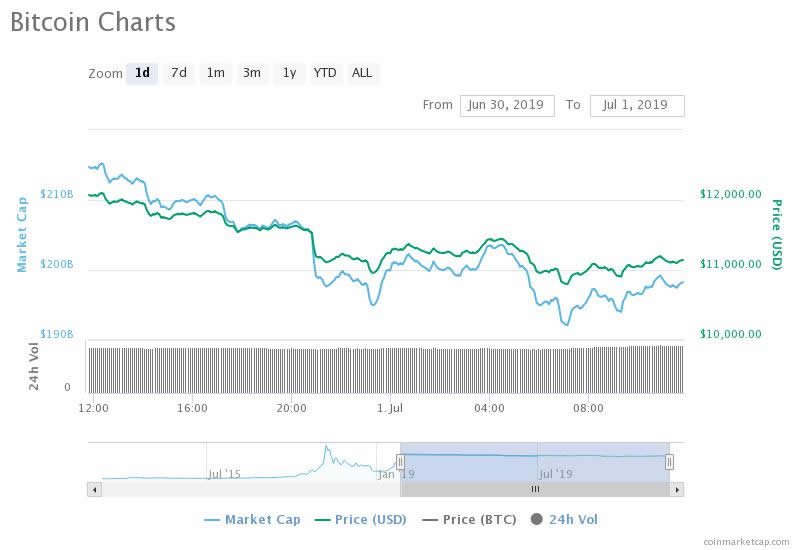

The Bitcoin network is looking stronger than ever but prices are starting to decline in a long awaited correction. The weekend had many thinking that the bulls could push higher, but those thoughts have been quashed Monday morning as markets continue to dump.

Bitcoin Dumps 9% on The Day

The weekend witnessed a minor resurgence from Bitcoin which managed to push back above $12k for a few hours. It could not hold there however and started a slow slide shedding a thousand dollars over the past day, dropping back to around $11k. The decline marks a 9 percent loss for BTC as crypto markets dump $25 billion.

The weekly closing candle has also indicated that further losses could be imminent as indecision between bulls and bears could signal a short term trend reversal. The portentous looking ‘shooting star’ candle has been widely commented on around CT with many eyeing levels of support below five figures.

The four hour chart has formed a descending channel with a pullback around the $9,000 area where the 200 EMA lies. This also ties up with a predicted correction of over 30 percent which would put BTC in the same zone from its recent high of $13,800.

Crypto trader Alex Krüger has mapped out all of the possible areas of support and resistance:

Very useful… thanks for posting https://t.co/KzyC9eKFZ4

— Thomas Lee (@fundstrat) July 1, 2019

Some are predicting range bound trading between high $8,000s and $14,000 for a few weeks before a push higher as the bull market continues.

“Bitcoin will range between $8,800 & $14,000 over the next couple of weeks to month (compiling the data from traders I’m inclined to trust over others). Afterward, $20,000 is the next target, with eyes toward $28,000 & $30,000, before a correction… we’ll reassess at that point.”

Bitcoin will range between $8,800 & $14,000 over the next couple of weeks to month (compiling the data from traders I'm inclined to trust over others).

Afterward, $20,000 is the next target, with eyes toward $28,000 & $30,000, before a correction… we'll reassess at that point.

— Omar Bham (Crypt0) (@crypt0snews) June 30, 2019

A little sideways action may not be a bad thing for Bitcoin. It would allow for more accumulation and may give some of the altcoins time to wake from their long hibernation.

Bitcoin Hash Rate Hits ATH

The Bitcoin network is still looking stronger than ever as hash rate, the horse power behind the computational calculations, has hit another all-time high. According to bitinfocharts.com BTC hash rate hit 68.37 exahashes/second over the weekend, the highest it has ever been. This has increased network security making BTC more systemically stable. As a result, difficulty is also at an all-time high of 7.93 T.

Bitcoin's hashrate is now at 69,000,000,000,000,000,000 hashes every second.

Hashrate is up 2x since Dec 2018 lows, and over 10x since Jun 2017. pic.twitter.com/1fdLnH5mtq

— Kevin Rooke (@kerooke) June 30, 2019

On the downside transaction fees have also increased, hitting a yearly high of $6.55 at the end of last week. Despite the current correction all indicators are strong for Bitcoin and it is likely to see out the year on a high. Since January first BTC is already up almost 200 percent and the institutions are still waiting on the sidelines.

Image from Shutterstock

The post Bitcoin Hash Rate Peaks But Pullback Still Looming as Analysts Eye $9k appeared first on NewsBTC.

from NewsBTC https://ift.tt/2XaC6na

Find The best Lending Program Top CryptocurrencyLending Program

Tidak ada komentar:

Posting Komentar